Last edit by: ZenFlyer

AAdvantage Aviator Silver and Red Cards from BarclayCard

There are five AAdvantage-linked Aviator-branded cards by Barclaycard. Two of them can be applied for directly, the other three are upgrades or downgrades after receiving a Red card.The Many Flavors of Barclaycard AAdvantage Aviator

Where can I see information on all available Barclays Barclaycard AAdvantage cards?

Aviator Red (On AA.com)

Aviator Silver (On AA.com)

Aviator Business (On AA.com)

Red cardholders may receive an offer to upgrade to Aviator Silver after a period of time that varies, usually 3-11 months. The offer appears in the online "Offers" section, if it is declined there may be no simple way to receive the upgrade. Be careful with your clicking! Silver benefits begin at the start of the next statement, but the increased annual fee won't hit until the next card-member year starts.

Aviator Silver Vs Red

Annual Fee: Silver $199 Red $99

Miles on AA Purchases: Silver 3x Red 2x

Miles on hotels and car rentals: Silver 2x, Red 1x

Miles on all other purchases: Silver 1x, Red 1x

Bonus Loyalty Points: Silver 5k LP after $20k/$40k/$50k Per Status Year Red None

In-Flight Food & Beverage: Silver $25 back/day Red 25% back

Wifi Credits: Silver $50/anniversary year Red $25/anniversary year

Companion Ticket: Silver 2 Companions Red 1 Companion (Minimum Anniversary-Year Spend Required for both)

PreCheck/Global Entry: Silver $100 credit Red No Credit

Card Benefit Details

FlyerTalk thread Citi & Barclaycard AAdvantage Credit Card Free Domestic Checked Bag / Baggage

Aviator Silver Bonus Loyalty Points: Bonuses are based on spend during status year, not anniversary year. When upgrading to Silver your Red spending will carry over. Five thousand Loyalty Points after spending $20k/$40k/$50k. You cannot stack multiple Silver accounts to earn this multiple times.

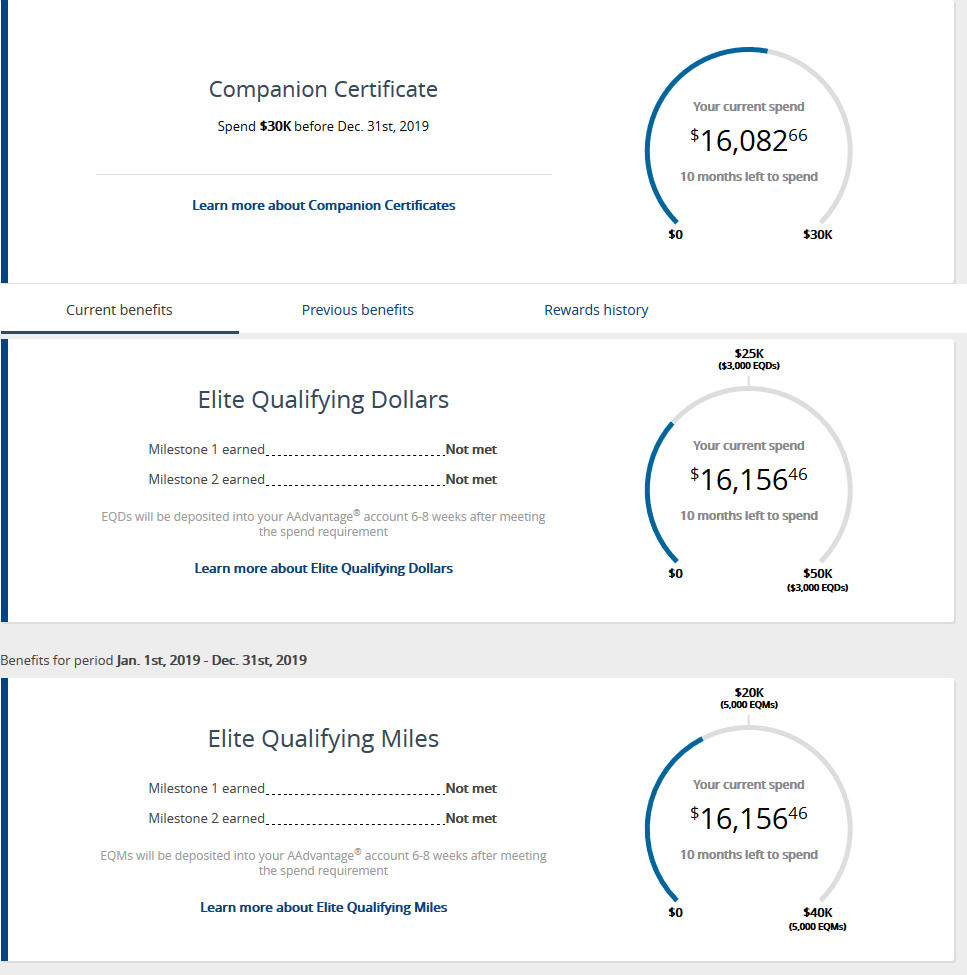

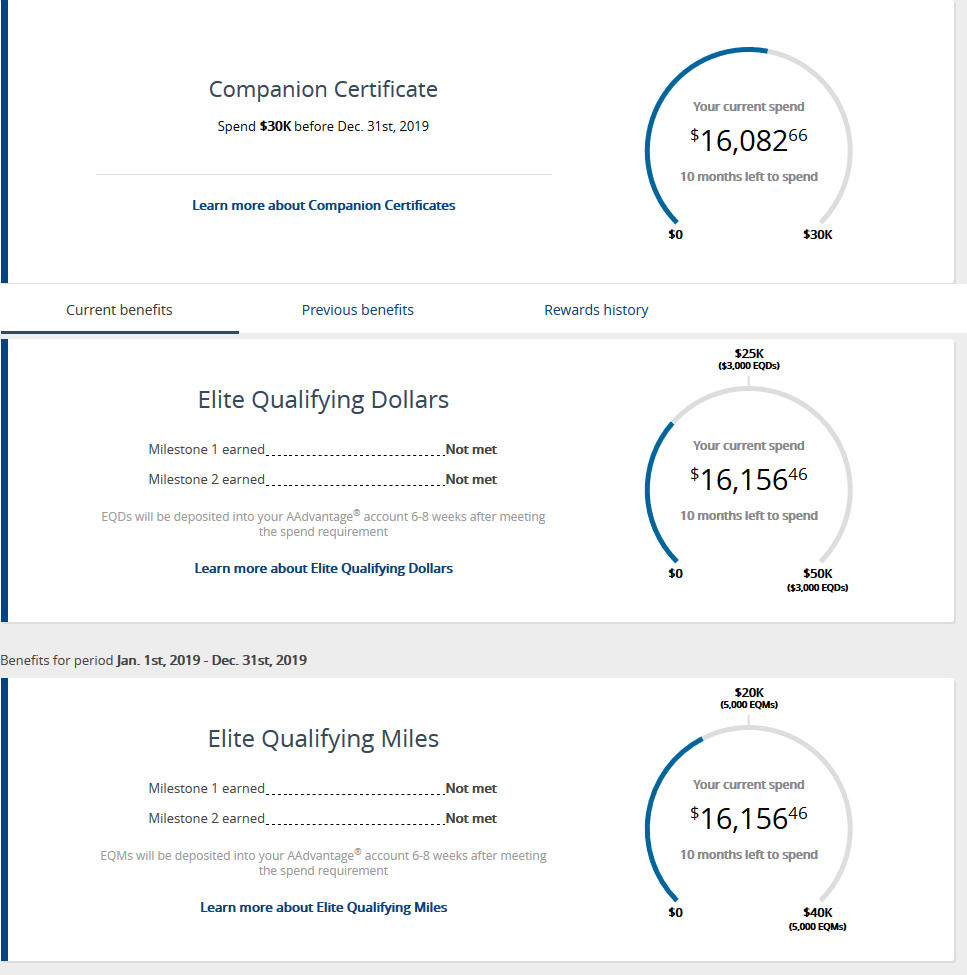

Companion Certificate: $20k in anniversary year spend required, issued about 45 days after you annual fee hits. Red gets one companion, Silver can have two. $99+tax for companions, round-trip 48 contiguous US States only unless you live in Alaska or Hawaii, in which case you may fly from your home state to the 48.

Barclaycard AAdvantage Aviator Silver and Red Cards (master thread)

#271

Join Date: Jun 2010

Location: Chicagoland

Programs: AA exp 3mm Hertz 5*

Posts: 334

Sitting here wondering what my alternatives are to the Citi AA Biz card... I appreciate your idea.

I don't know if Citi is melting down in fraud or what. They called me over a month ago about a suspicious charge. I viewed the account and pointed out five more. After six calls and three certified letters, they have ack'd three of them. But they haven't adjusted the payment due. What a zoo.Again, thanks for the answer to my problem...

I don't know if Citi is melting down in fraud or what. They called me over a month ago about a suspicious charge. I viewed the account and pointed out five more. After six calls and three certified letters, they have ack'd three of them. But they haven't adjusted the payment due. What a zoo.Again, thanks for the answer to my problem...

#273

Join Date: Mar 2010

Location: PHL

Programs: AA Executive Platinum; Hilton Diamond

Posts: 2,662

Took long enough to get the EQD tally on there, didn't it? Anyway, I still wonder why the three measurements do not always agree. The one always seems to be a day's transactions behind the others.

#274

Join Date: May 2005

Location: NYC

Programs: AA EXP 3mm, Hertz Presidents Circle, Marriott Lifetime Gold

Posts: 50

Glad to see EDQ back up there, and at the full $6k. Especially since the increase in EXP min EQD.

Completely makes it worth it to keep my Aviator Silver and not ditch for Citi.

Thank you!

Completely makes it worth it to keep my Aviator Silver and not ditch for Citi.

Thank you!

#275

Logged in this morning, noticed that EQD's are back on the reward center page.

Mine looks correct, up to 6k EDQ in 2019 for 50K spend. I PC'ed up to Silver Mar 2018, so per the AA site on Barlcays Cards - this is the correct card benefit I am due. Glad to see they got it sorted out.

Mine looks correct, up to 6k EDQ in 2019 for 50K spend. I PC'ed up to Silver Mar 2018, so per the AA site on Barlcays Cards - this is the correct card benefit I am due. Glad to see they got it sorted out.

#276

Join Date: Dec 2005

Location: South Florida

Programs: AA EXP, HH Diamond, Marriott Platinium

Posts: 1,334

Mine was showing that in January but now is showing 3K at 50K spend and I already spend $25k this calendar year. I opened my account sometime in March/April and I made the upgrade to Silver in July 2018.

#277

Join Date: Nov 2009

Programs: US CP and 1MM; HILTON DIAMOND; MARRIOTT PLAT

Posts: 80

Question if you can get 10K EQM on the Citi and the Barclays Cards for AA

My question is: Can you get 10K each from each of the silver aviator and the Citi card? (I recall reading on this website a few years back that you cannot). Thanks.

#278

Join Date: Jan 2013

Location: California

Programs: AA EXP 2MM, HH DIA, Hertz PC, GE + Pre✓, Amazon Super Special Prime

Posts: 1,008

I have had the Silver Aviator card for a while and used it to get 10K EQM each year. Now I think I need to get Admiral Club membership through the Citi World card, which also offers 10K EQM if you spend 40K.

My question is: Can you get 10K each from each of the silver aviator and the Citi card? (I recall reading on this website a few years back that you cannot). Thanks.

My question is: Can you get 10K each from each of the silver aviator and the Citi card? (I recall reading on this website a few years back that you cannot). Thanks.

#279

Join Date: Nov 2010

Location: LAX

Programs: AA EXP, SPG Gold

Posts: 181

Logged in this morning, noticed that EQD's are back on the reward center page.

Mine looks correct, up to 6k EDQ in 2019 for 50K spend. I PC'ed up to Silver Mar 2018, so per the AA site on Barlcays Cards - this is the correct card benefit I am due. Glad to see they got it sorted out.

Mine looks correct, up to 6k EDQ in 2019 for 50K spend. I PC'ed up to Silver Mar 2018, so per the AA site on Barlcays Cards - this is the correct card benefit I am due. Glad to see they got it sorted out.

#280

Join Date: Jun 2003

Location: INT/GSO/CLT/RDU

Programs: AA EXP 1MM; HH Gold; Bonvoy Gold; Wynd Diamond

Posts: 228

Has anyone had any experience attempting to get the miles deducted due to a credit from a merchant made to relate back to the initial purchase?

I had a $x000 charge posted in October and had about $1200 of it credited back last month. I would like for the 1200 not to count against my 2019 spending targets and since I surpassed all of last year's targets my more than $1200, I'd really like to have the credit relate back to the date of the charge.

I had a $x000 charge posted in October and had about $1200 of it credited back last month. I would like for the 1200 not to count against my 2019 spending targets and since I surpassed all of last year's targets my more than $1200, I'd really like to have the credit relate back to the date of the charge.

#281

Join Date: Jan 2004

Location: MIA

Posts: 298

Does anyone know why there is a specific carve-out of dates for the $50,000/6,000 EQD benefit?

Iím assuming itís because folks who upgraded to Silver inside of that window were somehow promised the benefit, but as someone who is not in that window it really rubs me the wrong way. Iíve been a loyal Silver customer for a very long time, and as far as Iím concerned I was also implicitly promised the benefit. If thereís a grandfathering of the benefit for an additional year, long time customerís should get the same consideration.

No telling what Barclaycardís big reveal is in March, but I am very likely to just walk away as a Barclaycard cardholder.

Iím assuming itís because folks who upgraded to Silver inside of that window were somehow promised the benefit, but as someone who is not in that window it really rubs me the wrong way. Iíve been a loyal Silver customer for a very long time, and as far as Iím concerned I was also implicitly promised the benefit. If thereís a grandfathering of the benefit for an additional year, long time customerís should get the same consideration.

No telling what Barclaycardís big reveal is in March, but I am very likely to just walk away as a Barclaycard cardholder.

Last edited by SouthernCross; Feb 21, 2019 at 11:43 am

#282

Join Date: Dec 2014

Location: New York City + Vail, CO

Programs: American Airlines Executive Platinum, Marriott Bonvoy Ambassador Elite

Posts: 3,223

Has anyone had any experience attempting to get the miles deducted due to a credit from a merchant made to relate back to the initial purchase?

I had a $x000 charge posted in October and had about $1200 of it credited back last month. I would like for the 1200 not to count against my 2019 spending targets and since I surpassed all of last year's targets my more than $1200, I'd really like to have the credit relate back to the date of the charge.

I had a $x000 charge posted in October and had about $1200 of it credited back last month. I would like for the 1200 not to count against my 2019 spending targets and since I surpassed all of last year's targets my more than $1200, I'd really like to have the credit relate back to the date of the charge.

#283

Join Date: Jun 2003

Location: INT/GSO/CLT/RDU

Programs: AA EXP 1MM; HH Gold; Bonvoy Gold; Wynd Diamond

Posts: 228

Does anyone know why there is a specific carve-out of dates for the $50,000/6,000 EQD benefit?

I’m assuming it’s because folks who upgraded to Silver inside of that window were somehow promised the benefit, but as someone who is not in that window it really rubs me the wrong way. I’ve been a loyal Silver customer for a very long time, and as far as I’m concerned I was also implicitly promised the benefit. If there’s a grandfathering of the benefit for an additional year, long time customer’s should get the same consideration.

No telling what Barclaycard’s big reveal is in March, but I am very likely to just walk away as a Barclaycard cardholder.

I’m assuming it’s because folks who upgraded to Silver inside of that window were somehow promised the benefit, but as someone who is not in that window it really rubs me the wrong way. I’ve been a loyal Silver customer for a very long time, and as far as I’m concerned I was also implicitly promised the benefit. If there’s a grandfathering of the benefit for an additional year, long time customer’s should get the same consideration.

No telling what Barclaycard’s big reveal is in March, but I am very likely to just walk away as a Barclaycard cardholder.

It seems that there were some marketing materials that didn't get modified to reflect the downgrade in benefits for new applicants, anyone who accepted one of those offers is due the full benefit of their bargain (if the offer included the old 3000/6000 EQD then those that accepted that offer are due the benefit). As much as it sucks for us, the offer we accepted was to continue to be cardholders under the terms of the October notice.

It may not be the greatest of customer service, but it is absolutely a legitimate contractual stance on Barclay's part.

#284

Join Date: Jun 2011

Posts: 3,522

Per Doctor of Credit

https://www.doctorofcredit.com/barcl...being-removed/

https://www.doctorofcredit.com/barcl...being-removed/

Aviator Red

This card will have the following benefits added:- Anniversary companion certificate. Get a companion certificate for 1 guest for $99 (plus taxes and fees) after account anniversary

- WiFi Credit. Up To $25 statement credit on American Airlines in flight WiFi purchases each card member year

- 10% rebate on miles redeemed up to 10,000 miles per calendar year.

- $100 American Airlines flight discount after qualifying purchases.

Aviator Silver

The following benefits are being added:- Anniversary companion certificate. Get a companion certificate for 2 guests for $99 (plus taxes and fees) after account anniversary

- WiFi Credit. Up to $50 statement credit on American Airlines in flight WiFi purchases each card member year

- Up to $25 daily statement credit for in-flight food and beverage purchases on American Airlines operated flights. (This replaces the current benefit of 25% back).

- 10% rebate on miles redeemed up to 10,000 miles per calendar year.