Last edit by: ZenFlyer

AAdvantage Aviator Silver and Red Cards from BarclayCard

There are five AAdvantage-linked Aviator-branded cards by Barclaycard. Two of them can be applied for directly, the other three are upgrades or downgrades after receiving a Red card.The Many Flavors of Barclaycard AAdvantage Aviator

Where can I see information on all available Barclays Barclaycard AAdvantage cards?

Aviator Red (On AA.com)

Aviator Silver (On AA.com)

Aviator Business (On AA.com)

Red cardholders may receive an offer to upgrade to Aviator Silver after a period of time that varies, usually 3-11 months. The offer appears in the online "Offers" section, if it is declined there may be no simple way to receive the upgrade. Be careful with your clicking! Silver benefits begin at the start of the next statement, but the increased annual fee won't hit until the next card-member year starts.

Aviator Silver Vs Red

Annual Fee: Silver $199 Red $99

Miles on AA Purchases: Silver 3x Red 2x

Miles on hotels and car rentals: Silver 2x, Red 1x

Miles on all other purchases: Silver 1x, Red 1x

Bonus Loyalty Points: Silver 5k LP after $20k/$40k/$50k Per Status Year Red None

In-Flight Food & Beverage: Silver $25 back/day Red 25% back

Wifi Credits: Silver $50/anniversary year Red $25/anniversary year

Companion Ticket: Silver 2 Companions Red 1 Companion (Minimum Anniversary-Year Spend Required for both)

PreCheck/Global Entry: Silver $100 credit Red No Credit

Card Benefit Details

FlyerTalk thread Citi & Barclaycard AAdvantage Credit Card Free Domestic Checked Bag / Baggage

Aviator Silver Bonus Loyalty Points: Bonuses are based on spend during status year, not anniversary year. When upgrading to Silver your Red spending will carry over. Five thousand Loyalty Points after spending $20k/$40k/$50k. You cannot stack multiple Silver accounts to earn this multiple times.

Companion Certificate: $20k in anniversary year spend required, issued about 45 days after you annual fee hits. Red gets one companion, Silver can have two. $99+tax for companions, round-trip 48 contiguous US States only unless you live in Alaska or Hawaii, in which case you may fly from your home state to the 48.

Barclaycard AAdvantage Aviator Silver and Red Cards (master thread)

#886

Moderator: American AAdvantage, Signatures

Join Date: Jan 2008

Location: London, England

Programs: UA 1K, Hilton Diamond, IHG Diamond Ambassador, National Exec, AA EXP Emeritus

Posts: 9,765

~Moderator

#887

Join Date: Dec 2019

Programs: AA: Exec Plat; AC: 75K; JX: Explorer; HH: Dia; Bonvoy: Gold; Wyndham: Dia

Posts: 298

I've gone back a number of pages on this thread and am still a bit unclear as I seem to see conflicting information from different people.

I have the red card. According to the spend counter, I am at $14k spend until October 31 (??) for my companion cert. I now have the offer to upgrade to the silver card. The main question I have is whether my $14k spend so far will still be there towards the companion cert and towards the bonus LPs? And is the bonus LP counter separate from the companion counter?

I have the red card. According to the spend counter, I am at $14k spend until October 31 (??) for my companion cert. I now have the offer to upgrade to the silver card. The main question I have is whether my $14k spend so far will still be there towards the companion cert and towards the bonus LPs? And is the bonus LP counter separate from the companion counter?

#888

Join Date: Feb 2002

Location: BOS

Programs: AA EXP 1MM, DL PM, Bonvoy Titanium (Plat Life), HH G, Amtrak, B6, MR

Posts: 1,547

Companion Cert qualification earning period is based on your anniversary year timing. Silver card spend bonuses will be based on Status qualification year (Mar-Feb). In this transition year to the LP program, we are getting the most recent Jan and Feb included as well, so 14 months. So your 2022 YTD spend should carry over if you upgrade to Silver for LP bonus purposes. It will likely be less than $14K as I am assuming that some of that spend took place Oct-Dec 2021.

#889

Join Date: Jun 2013

Posts: 6

I'm coming up on my 1 year anniversary with the Red card. I hardly ever use the card and would like to product change to the no annual fee card, has anyone had any luck doing this recently. Also when will the annual fee on my Red card start? I was on the offer with the first year annual fee waived.

#890

Join Date: Jun 2017

Location: Houston , TX

Programs: Platinum Pro. .Hilton Honors Gold,

Posts: 675

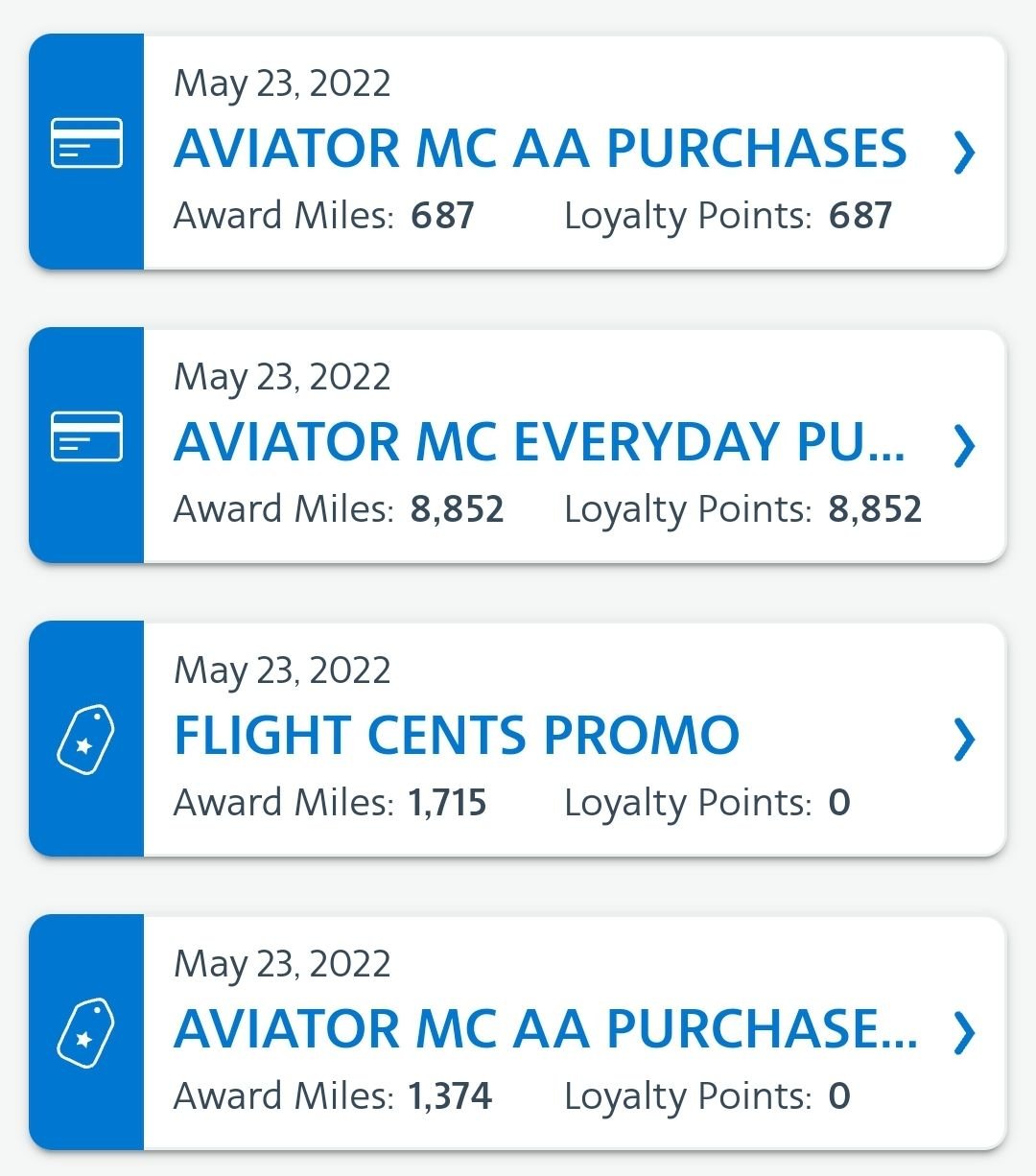

Reward Miles and LPs are 2 different things

I had a trip cancelled and after a $740 refund my miles earned took a -2178 hit. I only spent $1,352 dollars this month so my statement closed .

Miles earned for this period zero so Barclays didnít report any miles to American Airlines.

my statement reads miles earned with American -2178.

other non American purchases 1337

while I didnít earn miles due to the refunded ticket my argument is that I should still earn 1,352 LPs for the $1,352 I spent this month. And Barclays should report 0 miles earned and 1,352 LPs earned instead of nothing at all . Am I right ? Should I still earn the LPs as Miles are not LPs ?

or even the -740 LPs from the ticket refund would still be 612. Is it right ? Any advice ? Not even worth arguing ?

Miles earned for this period zero so Barclays didnít report any miles to American Airlines.

my statement reads miles earned with American -2178.

other non American purchases 1337

while I didnít earn miles due to the refunded ticket my argument is that I should still earn 1,352 LPs for the $1,352 I spent this month. And Barclays should report 0 miles earned and 1,352 LPs earned instead of nothing at all . Am I right ? Should I still earn the LPs as Miles are not LPs ?

or even the -740 LPs from the ticket refund would still be 612. Is it right ? Any advice ? Not even worth arguing ?

#891

Join Date: Mar 2014

Location: Cape Cod, MA, USA

Programs: American Airlines - Executive Platinum / Marriott - Ambassador

Posts: 45

I had a trip cancelled and after a $740 refund my miles earned took a -2178 hit. I only spent $1,352 dollars this month so my statement closed .

Miles earned for this period zero so Barclays didnít report any miles to American Airlines.

my statement reads miles earned with American -2178.

other non American purchases 1337

while I didnít earn miles due to the refunded ticket my argument is that I should still earn 1,352 LPs for the $1,352 I spent this month. And Barclays should report 0 miles earned and 1,352 LPs earned instead of nothing at all . Am I right ? Should I still earn the LPs as Miles are not LPs ?

or even the -740 LPs from the ticket refund would still be 612. Is it right ? Any advice ? Not even worth arguing ?

Miles earned for this period zero so Barclays didnít report any miles to American Airlines.

my statement reads miles earned with American -2178.

other non American purchases 1337

while I didnít earn miles due to the refunded ticket my argument is that I should still earn 1,352 LPs for the $1,352 I spent this month. And Barclays should report 0 miles earned and 1,352 LPs earned instead of nothing at all . Am I right ? Should I still earn the LPs as Miles are not LPs ?

or even the -740 LPs from the ticket refund would still be 612. Is it right ? Any advice ? Not even worth arguing ?

Last edited by pwendell; Jun 6, 2022 at 12:32 am

#892

Join Date: Sep 2017

Location: DCA/IAD & BUF

Posts: 1,391

I had a trip cancelled and after a $740 refund my miles earned took a -2178 hit. I only spent $1,352 dollars this month so my statement closed .

Miles earned for this period zero so Barclays didnít report any miles to American Airlines.

my statement reads miles earned with American -2178.

other non American purchases 1337

while I didnít earn miles due to the refunded ticket my argument is that I should still earn 1,352 LPs for the $1,352 I spent this month. And Barclays should report 0 miles earned and 1,352 LPs earned instead of nothing at all . Am I right ? Should I still earn the LPs as Miles are not LPs ?

or even the -740 LPs from the ticket refund would still be 612. Is it right ? Any advice ? Not even worth arguing ?

Miles earned for this period zero so Barclays didnít report any miles to American Airlines.

my statement reads miles earned with American -2178.

other non American purchases 1337

while I didnít earn miles due to the refunded ticket my argument is that I should still earn 1,352 LPs for the $1,352 I spent this month. And Barclays should report 0 miles earned and 1,352 LPs earned instead of nothing at all . Am I right ? Should I still earn the LPs as Miles are not LPs ?

or even the -740 LPs from the ticket refund would still be 612. Is it right ? Any advice ? Not even worth arguing ?

I'll probably give up at this point because it's only ~ 300 LP hit for me. But it's still annoying. And always in the back of mind it's going to be a continuous problem when I have a negative AA balance for the month.

#893

Join Date: Jun 2017

Location: Houston , TX

Programs: Platinum Pro. .Hilton Honors Gold,

Posts: 675

I have a similar situation. Agents can see there's a discrepancy when I walk through it with them, however it still isn't reconciled properly, after two months of an open case file. Have spent easily 20-30 hours on it, including multiple calls.

I'll probably give up at this point because it's only ~ 300 LP hit for me. But it's still annoying. And always in the back of mind it's going to be a continuous problem when I have a negative AA balance for the month.

I'll probably give up at this point because it's only ~ 300 LP hit for me. But it's still annoying. And always in the back of mind it's going to be a continuous problem when I have a negative AA balance for the month.

#895

Join Date: Nov 2018

Location: PHX

Programs: AAdvantage EP, Bonvoy Gold Elite

Posts: 38

Mine was much faster - it really depends on timing.

#897

Join Date: Jun 2017

Location: Houston , TX

Programs: Platinum Pro. .Hilton Honors Gold,

Posts: 675

I called Barclays and they got me in touch with American. It was good customer service. I refunded a $750 ticket last month and Barclays didnít report anything because I earned 0 rewards miles but I told them since I still spent $1,300 dollars last month i should have still received 1,300 LPs as miles and LPs are 2 different things. A small amount of LPs but you never know down the road at the end of Feb next year if youíre going to be just shy of the next status. They are looking into it. Whatever.

#898

Join Date: Aug 2002

Location: WAS/TYO

Programs: UA 1K, AA EXP (3MM), DL PM, BONVOY TITANIUM, HYATT GLOBALIST, HILTON DIAMOND, IHG DIAMOND AMB, et al

Posts: 5,913

As a datapoint: my $20k spend threshold was achieved on 05/03 and the 5k LPs posted to my account today (6/10). So just over 5 weeks (and under the 6-8 weeks published timeline).

-FlyerBeek

-FlyerBeek

#899

Join Date: Dec 2003

Location: Washington, DC

Programs: Hyatt Globalist, AA Executive Platinum

Posts: 1,932

I got an offer of 1000 LP after any purchase on my (basically unused) aviator red. The fine print says the account has to remain open to get the points. I guess this is a preemptive retention offer?

I also have the offer to upgrade to silver. Iím planning to cancel it anyway I think. I have the citi exec, and canít think of any reason to keep an aviator open.

I also have the offer to upgrade to silver. Iím planning to cancel it anyway I think. I have the citi exec, and canít think of any reason to keep an aviator open.

#900

Join Date: Oct 2008

Location: NYS

Programs: Days of Our Lives, General Hospital

Posts: 1,495

Bonus for upgrading to red?

Is there ever a bonus from Barclays for upgrading an Aviator Blue card to Red? I plan to do this for the checked bag, but the first flight where I need that isn't imminent.