How to maximize AC/Aeroplan benefits with new Aeroplan- co-branded credit cards?

#1

Original Poster

Join Date: Sep 2000

Location: Ottawa, Ontario, Canada

Programs: Aeroplan SE AND 1MM, HHonors Gold, Marriott Bonvoy Platinum , L'Accor Platinum

Posts: 9,580

How to maximize AC/Aeroplan benefits with new Aeroplan- co-branded credit cards?

I am AMEX Aeroplus Platinum (now AMEX Reserve) cardholder, plus AMEX Gold Rewards cardholder, plus TD VISA Infinite cardholder.

Annual fees are $599 for AMEX Reserve card (with $100 credit if $3000 spent in first month - I do not know if that is fo new cardholders only, or also for existing cardholders), plus $150 for AMEX Gold rewards card plus $139 for TD infinite privilege card.

Pre-Nov 8 - to maximize Aeroplan miles/points: : I would use my AMEX Gold card for supermarkets/gas stations/pharmacies in Canada and all travel related bookings (Canada or otherwise) at 2 MR/dollar spent - with transfer to Aeroplan at 1 to 1 basis. I would use AMEX Aeroplus Platinum card for everywhere else where it was accepted, and TD VISA where AMEX was not accepted

Now, my goal it is first priority to maximize SQM/SQSs and eupgrade credits - esp if both can be banked for the following year; and secondly to maximize Aeroplan miles.

1. So with new AMEX reserve card - most of my AC bookings will earn 3 Aeroplan miles/dollar spent. No brainer.

2. But what do I do about other travel related bookings - AMEX reserve only gives 1 Aeroplan mile/dollar spent. Do I now I stay with AMEX Gold reserve card, or stay with one or both of AMEX reserve or TD VISA infinite card - which may lead me to the SQM/SQS benefit and eupgrade benefit, but I only get 1 Aeroplan mile per dollar spent- or do I go to the Gold Rewards card for 2 MR=Aeroplan miles per dollar spent but no SQM/SQS and eupgrade benefits?

3. With Canadian supermarkets/gas stations/pharmacies - do I stick with AMEX Gold reward cards, or do I go to AMEX Reserve or TD VISA Infinite card.

4. All other charges - no brainer- I use the AMEX reserve or TD VISA Infinite.

Alternatively - I cancel the AMEX Gold Rewards AMEX card and TD VISA infinite card - and I get the TD VISA Infinite privilege card. Yes, somewhat more annual card fees (but ameliorated by fact that AMEX Aeroplus Platinum cardholders who now have the AMEX reserve card will have the first year's annual fee of $599 credited - I got that confimed in writing by AMEX customer service when I was asking in writing about some of the benefits of the new AMEX reserve card)

But I think I get a one time buddy pass by gettting the TD VISA infinite privilege card (which I think is considered slightly superior to the CIBC version of that card?). I get .1.25 Aeroplan miles per dollar spent for at least the basic charges. I get the SQM/SQS and eupgrade benefits.

For now, I do not think that the discount to Aeroplan award bookings that I get as a SE is increased by any Aeroplan co-branded credit card or credit cards I have - so I do not think that getting a TD VISA infinite privilege card by replacing the TD Infinite card will be beneficial (at least for now) in that respect.

Your thoughts?

Annual fees are $599 for AMEX Reserve card (with $100 credit if $3000 spent in first month - I do not know if that is fo new cardholders only, or also for existing cardholders), plus $150 for AMEX Gold rewards card plus $139 for TD infinite privilege card.

Pre-Nov 8 - to maximize Aeroplan miles/points: : I would use my AMEX Gold card for supermarkets/gas stations/pharmacies in Canada and all travel related bookings (Canada or otherwise) at 2 MR/dollar spent - with transfer to Aeroplan at 1 to 1 basis. I would use AMEX Aeroplus Platinum card for everywhere else where it was accepted, and TD VISA where AMEX was not accepted

Now, my goal it is first priority to maximize SQM/SQSs and eupgrade credits - esp if both can be banked for the following year; and secondly to maximize Aeroplan miles.

1. So with new AMEX reserve card - most of my AC bookings will earn 3 Aeroplan miles/dollar spent. No brainer.

2. But what do I do about other travel related bookings - AMEX reserve only gives 1 Aeroplan mile/dollar spent. Do I now I stay with AMEX Gold reserve card, or stay with one or both of AMEX reserve or TD VISA infinite card - which may lead me to the SQM/SQS benefit and eupgrade benefit, but I only get 1 Aeroplan mile per dollar spent- or do I go to the Gold Rewards card for 2 MR=Aeroplan miles per dollar spent but no SQM/SQS and eupgrade benefits?

3. With Canadian supermarkets/gas stations/pharmacies - do I stick with AMEX Gold reward cards, or do I go to AMEX Reserve or TD VISA Infinite card.

4. All other charges - no brainer- I use the AMEX reserve or TD VISA Infinite.

Alternatively - I cancel the AMEX Gold Rewards AMEX card and TD VISA infinite card - and I get the TD VISA Infinite privilege card. Yes, somewhat more annual card fees (but ameliorated by fact that AMEX Aeroplus Platinum cardholders who now have the AMEX reserve card will have the first year's annual fee of $599 credited - I got that confimed in writing by AMEX customer service when I was asking in writing about some of the benefits of the new AMEX reserve card)

But I think I get a one time buddy pass by gettting the TD VISA infinite privilege card (which I think is considered slightly superior to the CIBC version of that card?). I get .1.25 Aeroplan miles per dollar spent for at least the basic charges. I get the SQM/SQS and eupgrade benefits.

For now, I do not think that the discount to Aeroplan award bookings that I get as a SE is increased by any Aeroplan co-branded credit card or credit cards I have - so I do not think that getting a TD VISA infinite privilege card by replacing the TD Infinite card will be beneficial (at least for now) in that respect.

Your thoughts?

#2

Join Date: Jul 2008

Location: YVR

Programs: OZ Diamond, Jiffypark Manhattan Gold

Posts: 4,485

I just looked at these, they're unfortunate. Looks like no bonuses at all from CIBC? ... is that? Personally I don't like the methods to earn the miles from AMEX, it's always harder to use AMEX, and I don't love having to keep $1000 a month with them, that said I understand it from their side. The TD cards seem ok, but to get 50,000 points you gotta have an income of $200,000? What's up there? Is this COVID related? Like they don't wanna give out big miles as they're already kinda hurting? If anything I would've thought they'd have massive bonuses with a new program and people having more disposable income in many cases as they're working but not going anywhere and not going out as much.

#3

Join Date: Dec 2017

Location: SFO/YYZ

Programs: AC 25K, AS MVP Gold, BA Bronze, UA Silver, Marriott Titanium, Hilton Diamond, Hyatt Globalist

Posts: 2,467

I just looked at these, they're unfortunate. Looks like no bonuses at all from CIBC? ... is that? Personally I don't like the methods to earn the miles from AMEX, it's always harder to use AMEX, and I don't love having to keep $1000 a month with them, that said I understand it from their side. The TD cards seem ok, but to get 50,000 points you gotta have an income of $200,000? What's up there? Is this COVID related? Like they don't wanna give out big miles as they're already kinda hurting? If anything I would've thought they'd have massive bonuses with a new program and people having more disposable income in many cases as they're working but not going anywhere and not going out as much.

#4

Join Date: Oct 2017

Posts: 35

On my part i still kept the Amex Platinum still debating cancelling this one

I have the Aeroplan Platinum that became Reserve Aeroplan ( i called Amex two time they seem confused , all their web site says that the new Reserve Amex Aeroplan is a Credit Card. so i was questioning how they will manage the change from a Charge Card to Credit ?

The Agent says hum confusion indeed ! after they verify they says that the new Amex Reserve Aeroplan will stay charge! But new applicant it will be a Credit Card ! But i refereed on their site nothing is says about Reserve Amex Aeroplan as a Charge card. The answer was it's been not annonce yet ! ) So anyone heard about Amex having two type of Reserve Aeroplan Card ?

Still keeping for now the Visa infinite Aeroplan for all those place Amex not accepted

Cheers

I have the Aeroplan Platinum that became Reserve Aeroplan ( i called Amex two time they seem confused , all their web site says that the new Reserve Amex Aeroplan is a Credit Card. so i was questioning how they will manage the change from a Charge Card to Credit ?

The Agent says hum confusion indeed ! after they verify they says that the new Amex Reserve Aeroplan will stay charge! But new applicant it will be a Credit Card ! But i refereed on their site nothing is says about Reserve Amex Aeroplan as a Charge card. The answer was it's been not annonce yet ! ) So anyone heard about Amex having two type of Reserve Aeroplan Card ?

Still keeping for now the Visa infinite Aeroplan for all those place Amex not accepted

Cheers

#5

Join Date: Aug 2009

Location: YLW

Programs: AC- SE100 1MM, Hilton Diamond, Marriott Platinum, National Executive, Nexus/GE

Posts: 4,307

The AMEX Gold I still believe is the best value because of the 2 points for $1 at so many places and the 1:1 ratio to Aeroplan, Avios, etc for only $150 per annum

The TD VISA Infinite card is the Aeroplan card so I am covered with benefits for the new AP program and that is free because of my account at TD

Last night I applied and was approved for the AMEX Core card as I wanted the Buddy pass and the extra 20,000 AP points, the first-year fee waived. This card I may toss after the first year as I have the AMEX Gold and the AMEX Hilton US card

CIBC Basic VISA card has no annual fee and gives you a 10,000 AP Bonus so I may apply for this and keep the card for six months and then toss

Why not cash in on the point offerings? Most of the card benefits we already get as Elites or Super Elites.

The TD VISA Infinite card is the Aeroplan card so I am covered with benefits for the new AP program and that is free because of my account at TD

Last night I applied and was approved for the AMEX Core card as I wanted the Buddy pass and the extra 20,000 AP points, the first-year fee waived. This card I may toss after the first year as I have the AMEX Gold and the AMEX Hilton US card

CIBC Basic VISA card has no annual fee and gives you a 10,000 AP Bonus so I may apply for this and keep the card for six months and then toss

Why not cash in on the point offerings? Most of the card benefits we already get as Elites or Super Elites.

#6

Join Date: Nov 2013

Location: YOW

Programs: AC SE, Marriott Platinum

Posts: 395

Unless I missed something the Amex is not FYF?

#7

Join Date: Aug 2009

Location: YLW

Programs: AC- SE100 1MM, Hilton Diamond, Marriott Platinum, National Executive, Nexus/GE

Posts: 4,307

Yes, you are right there is no waiver of fee for the first year. I had mine waived as I spoke with them this morning when I called for another matter.

I got a little too excited about the FYF as I had done so much research to maximize the best bang for my buck and it's a blur!

Thanks for pointing that out

P.S. Love your website

#8

Join Date: Nov 2005

Location: YSC (and all its regularly scheduled flights)

Posts: 2,519

Dr. PITUK

#9

Join Date: Jan 2020

Programs: Aeroplan

Posts: 182

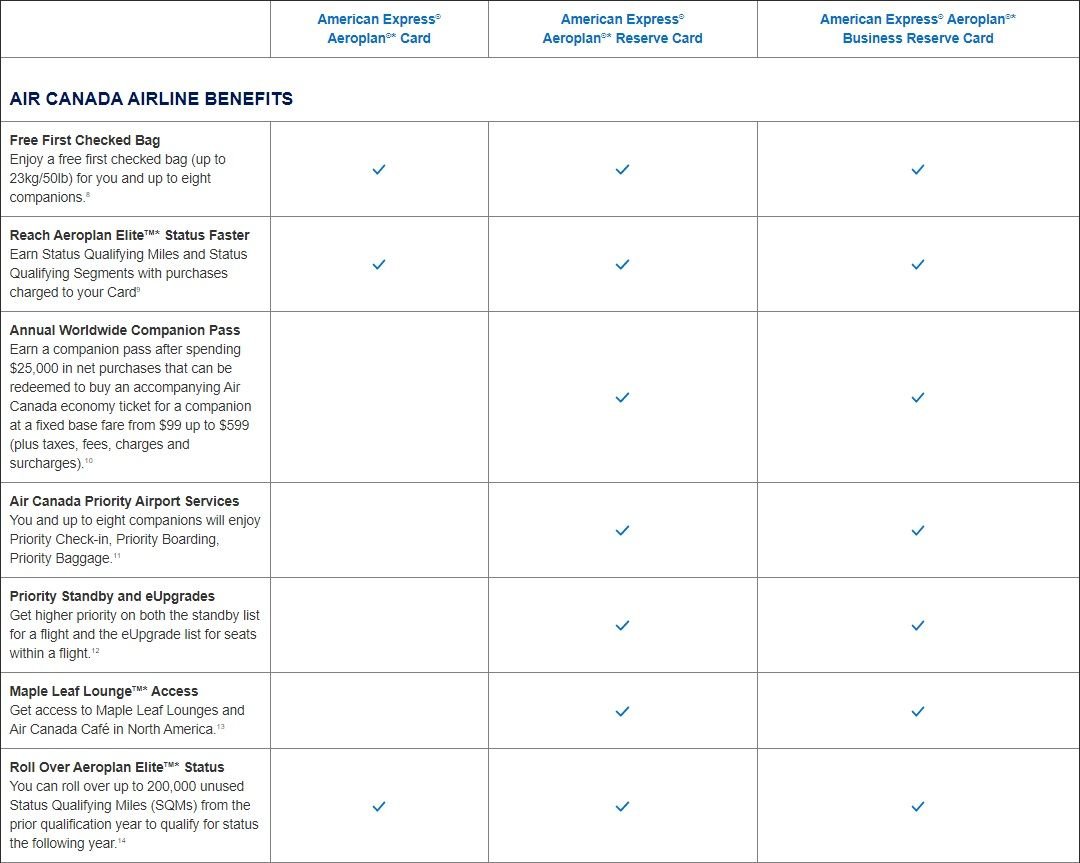

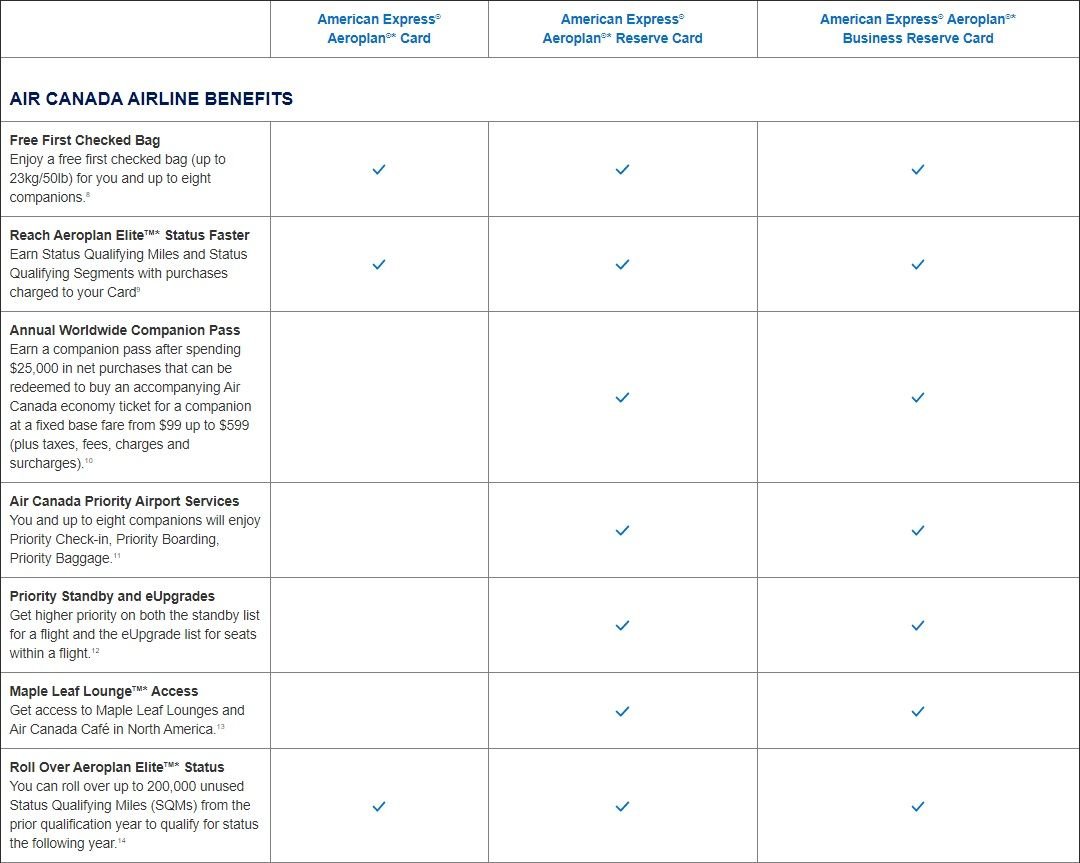

I'm not sure if this info is correct. Under the compare cards page, this is what I see.

From my understanding, the SQM roll over is only applicable for the premium cards and not the core card. On the AMEX Aeroplan Card Page, there is no mention of roll over SQM.

From my understanding, the SQM roll over is only applicable for the premium cards and not the core card. On the AMEX Aeroplan Card Page, there is no mention of roll over SQM.

#10

Join Date: Nov 2005

Location: YSC (and all its regularly scheduled flights)

Posts: 2,519

Dr. PITUK

#11

Join Date: Jan 2020

Programs: Aeroplan

Posts: 182

Reach Aeroplan Elite Status More Easily

Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $5,000 in eligible net purchases charged to your Card.10 You can also roll over up to 200,000 unused Status Qualifying Miles (SQMs) from the prior qualification year to qualify for status the following year.5

Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $5,000 in eligible net purchases charged to your Card.10 You can also roll over up to 200,000 unused Status Qualifying Miles (SQMs) from the prior qualification year to qualify for status the following year.5

Reach Aeroplan EliteTM* Status Faster

Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $10,000 in eligible net purchases charged to your Card.5

Earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $10,000 in eligible net purchases charged to your Card.5

#12

Join Date: Jan 2009

Location: YOW

Programs: AC-SE100K, AC-3MM, Marriott- LT Titanium, SPG RIP

Posts: 2,958

Got an email from CIBC about the features of my current Visa Infinite Privilege card. There is no mention of rollover eUpgrade credits. Can anyone here confirm whether that is a thing with this credit card or not?

If not, I will apply for one that has this feature and drop this CIBC card at next annual fee payment time.

Thanks

If not, I will apply for one that has this feature and drop this CIBC card at next annual fee payment time.

Thanks

#13

Join Date: Aug 2013

Location: YVR - MILLS Waypoint (It's the third house on the left)

Programs: AC*SE100K, wood level status in various other programs

Posts: 6,226

Got an email from CIBC about the features of my current Visa Infinite Privilege card. There is no mention of rollover eUpgrade credits. Can anyone here confirm whether that is a thing with this credit card or not?

If not, I will apply for one that has this feature and drop this CIBC card at next annual fee payment time.

Thanks

If not, I will apply for one that has this feature and drop this CIBC card at next annual fee payment time.

Thanks

CIBC Aeroplan Visa Infinite Privilege Card primary cardholders who also hold Aeroplan Elite Status will be able to roll over up to a maximum of 50 eUpgrade Credits received in the prior status year to the next benefit year. eUpgrade Credits issued on a promotional basis, as well as those already rolled over from a previous benefit year, are not eligible for this benefit. Rollover eUpgrade Credits will be deposited directly into the memberís Aeroplan account no later than March 30 of any given year, provided the member holds Aeroplan Elite Status at that time, and held Aeroplan Elite Status in the previous benefit year. If your CIBC Aeroplan credit card account is not in Good Standing, or if it is closed, regardless of reason for closure, or if the CIBC Aeroplan credit card product is changed to a different product, any unused, rolled-over eUpgrade Credits will be forfeited and removed from the memberís eUpgrade account. Benefit is only available to primary cardholders and does not apply to authorized users. Where a primary cardholder is eligible to roll over eUpgrade Credits under another Aeroplan credit card, the total cumulative rollover of all eUpgrade Credits cannot exceed the maximum of 50 eUpgrade Credits. All eUpgrade conditions apply and can be reviewed at aircanada.com/eupgrade-termsandconditions.

#14

Join Date: Sep 2008

Location: YVR

Programs: AC*SE-MM, BA Bronze, Marriott Titanium & lifetime Plat

Posts: 1,820

On the branded credit cards / family integration of Aeroplan. My wife has an Aeroplan-branded credit card. I don't. Our Aeroplan accounts are linked. Do I automatically get the "benefits" of her card when booking award tickets or does it only apply if I get a "secondary" credit card on her account?