Last edit by: yyznomad

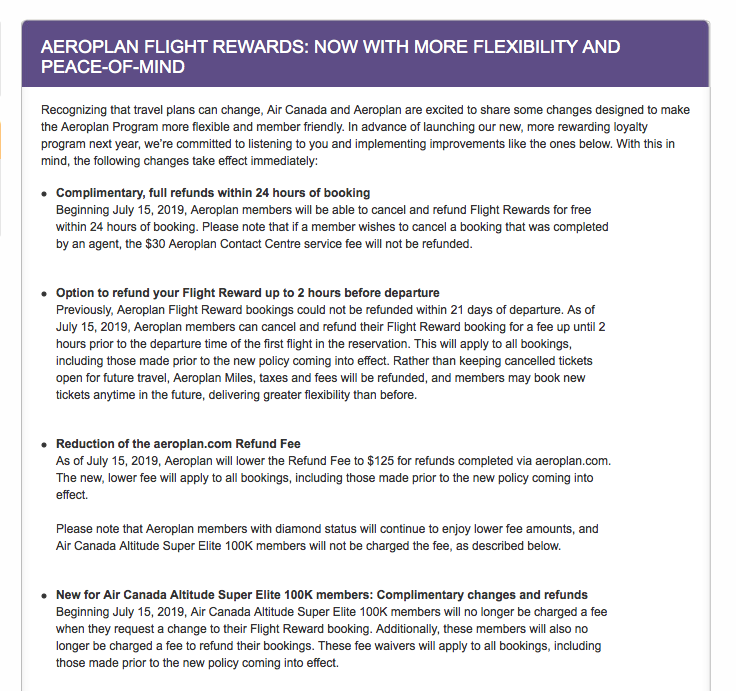

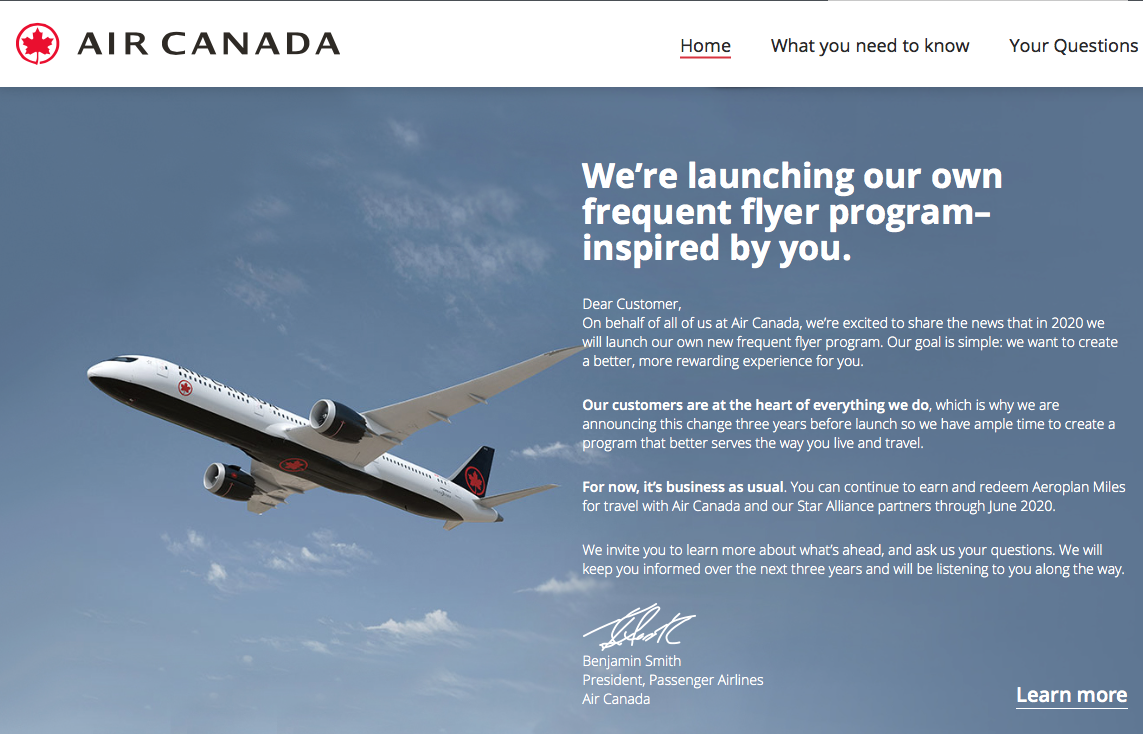

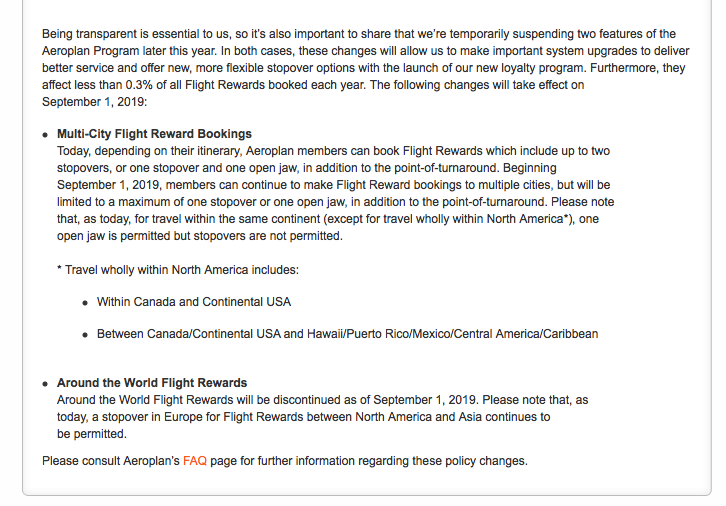

Such that it is actually searchable text - one of the important changes to the Aeroplan program in 2019 for Super Elites:

New for Air Canada Altitude Super Elite 100K members: Complimentary changes and refunds

Beginning July 15, 2019, Air Canada Super Elite 100K members will no longer be charged a fee when they request a change to their Flight Reward booking. Additionally, these members will also no longer be charged a fee to refund their bookings. These fee waivers will apply to all bookings, including those made prior to the new policy coming into effect.

Read the below screenshots for the rest.

July 15 2019

"AEROPLAN FLIGHT REWARDS: NOW WITH MORE FLEXIBILITY AND PEACE-OF-MIND"

https://www.aeroplan.com/whats_new/news_articles.do?dl=WhatsNew_WEBUP31000285_2019_07 _15¤tLanguage=en

New chart with fees in this post

https://www.flyertalk.com/forum/31306687-post1334.html

Older news releases from 2017 below

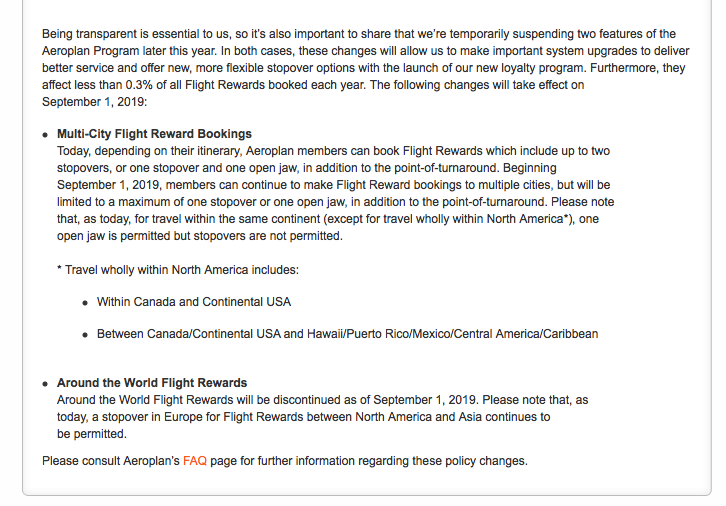

Air Canada "What You Need to Know"

https://www.aircanada.com/ca/en/aco/...d-to-know.html

Air Canada Press Release May 11, 2017

http://aircanada.mediaroom.com/index.php?s=43&item=1135

Aeroplan News "To Our Valued Members" - May 11, 2017

https://www5.aeroplan.com/whats_new/...New_2017_05_09

Aeroplan & Air Canada update

We'd like to help our members understand the latest news about our partner, Air Canada.

https://www5.aeroplan.com/aircanada-...id=BAN30000311

From Aeroplan - UPDATE May 31, 2017

https://www5.aeroplan.com/aircanada-and-aeroplan-update.do

Aeroplan Saga Ends in a Long, Financial Detour:

https://www.theglobeandmail.com/repo...ticle35080509/

August 11 2017

"We're on solid ground so your plans can take flight."

https://www.aeroplan.com/program-updates.do?currentLanguage=en&cid=008692096

"Five things you need to know about your miles"

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

September 19, 2017 - Investor Day Presentation

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

//

New for Air Canada Altitude Super Elite 100K members: Complimentary changes and refunds

Beginning July 15, 2019, Air Canada Super Elite 100K members will no longer be charged a fee when they request a change to their Flight Reward booking. Additionally, these members will also no longer be charged a fee to refund their bookings. These fee waivers will apply to all bookings, including those made prior to the new policy coming into effect.

Read the below screenshots for the rest.

July 15 2019

"AEROPLAN FLIGHT REWARDS: NOW WITH MORE FLEXIBILITY AND PEACE-OF-MIND"

https://www.aeroplan.com/whats_new/news_articles.do?dl=WhatsNew_WEBUP31000285_2019_07 _15¤tLanguage=en

New chart with fees in this post

https://www.flyertalk.com/forum/31306687-post1334.html

Older news releases from 2017 below

Air Canada "What You Need to Know"

https://www.aircanada.com/ca/en/aco/...d-to-know.html

Air Canada Press Release May 11, 2017

http://aircanada.mediaroom.com/index.php?s=43&item=1135

Aeroplan News "To Our Valued Members" - May 11, 2017

https://www5.aeroplan.com/whats_new/...New_2017_05_09

Aeroplan & Air Canada update

We'd like to help our members understand the latest news about our partner, Air Canada.

https://www5.aeroplan.com/aircanada-...id=BAN30000311

From Aeroplan - UPDATE May 31, 2017

https://www5.aeroplan.com/aircanada-and-aeroplan-update.do

Aeroplan Saga Ends in a Long, Financial Detour:

https://www.theglobeandmail.com/repo...ticle35080509/

August 11 2017

"We're on solid ground so your plans can take flight."

https://www.aeroplan.com/program-updates.do?currentLanguage=en&cid=008692096

"Five things you need to know about your miles"

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

September 19, 2017 - Investor Day Presentation

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

//

Air Canada to Launch Its Own Loyalty Program in 2020

#511

FlyerTalk Evangelist

Join Date: Jun 2003

Location: YYC

Posts: 23,803

It appears the amounts paid by AE to AC for tickets may have quite a bit lower than I imagined...

#512

Original Member

Join Date: May 1998

Location: Vancouver, Canada

Posts: 6,222

I've talked to a few friends who are need to burn a TON of AE points now and it is going to take years. They are going to cut deals with their employers to sub in award flights for what should have been revenue flights and make some side cash.

Interesting to think of the lost revenue when you extrapolate this concept over everyone needing to travel over the next few years!

The number of pitfalls in this mess are quite considerable.

Interesting to think of the lost revenue when you extrapolate this concept over everyone needing to travel over the next few years!

The number of pitfalls in this mess are quite considerable.

But what's the catch?

#513

Join Date: Apr 2000

Location: Mississauga Ontario

Posts: 4,103

Since AC is still promoting Aeroplan on their site post unpinning, I am going to go with a world of lawsuits should they try and renege on travel booked up until the date they stop promoting Aeroplan as their miles partner. I personally know of a few law firms mulling class action ...although that is drastic at this stage.

https://www.aircanada.com/ca/en/aco/.../aeroplan.html

https://www.aircanada.com/ca/en/aco/.../aeroplan.html

I would expect that behind the scenes is an unholy mess of a divorce, and that their hands are pretty much tied to do anything up until the date of.

#515

Join Date: Jun 2016

Programs: air miles

Posts: 283

If CC earners are the problem than why are people saying that Air Canada needs to partner with a bank (I.E. CC spending)?

One would think that the aim would be a pure FF model where status is gained on flights flown and money spent within the airline/alliance group

One would think that the aim would be a pure FF model where status is gained on flights flown and money spent within the airline/alliance group

#516

Join Date: Nov 2013

Location: YOW

Programs: AC SE, Marriott Platinum

Posts: 395

If CC earners are the problem than why are people saying that Air Canada needs to partner with a bank (I.E. CC spending)?

One would think that the aim would be a pure FF model where status is gained on flights flown and money spent within the airline/alliance group

One would think that the aim would be a pure FF model where status is gained on flights flown and money spent within the airline/alliance group

https://www.bloomberg.com/news/artic...les-than-seats

AC needs to bring the program in house.

#517

A FlyerTalk Posting Legend

Join Date: Sep 2012

Location: SFO

Programs: AC SE MM, BA Gold, SQ Silver, Bonvoy Tit LTG, Hyatt Glob, HH Diamond

Posts: 44,324

If CC earners are the problem than why are people saying that Air Canada needs to partner with a bank (I.E. CC spending)?

One would think that the aim would be a pure FF model where status is gained on flights flown and money spent within the airline/alliance group

One would think that the aim would be a pure FF model where status is gained on flights flown and money spent within the airline/alliance group

Because today AE is the one who reaps the benefit of selling points to the Credit Card issuers. AC has missed out on this revenue stream because they don't own their own FFP. My guess is that this is the main driver for the decision to break with AE. Take a look at the US carriers:

https://www.bloomberg.com/news/artic...les-than-seats

AC needs to bring the program in house.

https://www.bloomberg.com/news/artic...les-than-seats

AC needs to bring the program in house.

#518

Suspended

Join Date: Sep 2014

Programs: AC SE100K-1MM, NH, DL, AA, BA, Global Entry/Nexus, APEC..

Posts: 18,877

Because today AE is the one who reaps the benefit of selling points to the Credit Card issuers. AC has missed out on this revenue stream because they don't own their own FFP. My guess is that this is the main driver for the decision to break with AE. Take a look at the US carriers:

https://www.bloomberg.com/news/artic...les-than-seats

AC needs to bring the program in house.

https://www.bloomberg.com/news/artic...les-than-seats

AC needs to bring the program in house.

Thread from March 31

http://www.flyertalk.com/forum/air-c...han-seats.html

As I wrote in the OP:

I loved the sub-headline:

"The golden goose isn’t your ticket or bag fee—it’s the credit card you use to collect frequent flier miles."

#519

Join Date: Mar 2007

Posts: 4,784

#521

Join Date: Oct 2008

Location: YYC

Posts: 4,035

#523

Join Date: Nov 2004

Location: YYZ, HKG, MFM

Programs: AC35K, AS MVP, WS Gold, ITA EP, Marriott Plat, Hyatt-Explorist, IHG Diamond

Posts: 2,019

wow I thought they will stabilize around 3.5-4.0 by now. If they drop below $2, I will need to burn off my AP immediately.

#524

Aimia Inc (TSE:AIM)‘s stock had its “hold” rating reissued by stock analysts at TD Securities in a note issued to investors on Thursday, May 4th. They currently have a C$9.50 price target on the stock. TD Securities’ target price would indicate a potential upside of 163.89% from the stock’s previous close.

Other analysts have also recently issued reports about the stock. Raymond James Financial, Inc. reaffirmed an “outperform” rating and set a C$12.50 target price on shares of Aimia in a report on Friday, February 17th. Scotiabank upped their target price on shares of Aimia from C$8.50 to C$9.50 and gave the company a “sector perform” rating in a report on Tuesday, February 21st. Finally, Royal Bank of Canada reaffirmed a “sector perform” rating and set a C$9.00 target price on shares of Aimia in a report on Tuesday, February 21st. Two analysts have rated the stock with a sell rating, five have issued a hold rating and one has issued a buy rating to the company’s stock. The company has an average rating of “Hold” and an average target price of C$7.03.

Other analysts have also recently issued reports about the stock. Raymond James Financial, Inc. reaffirmed an “outperform” rating and set a C$12.50 target price on shares of Aimia in a report on Friday, February 17th. Scotiabank upped their target price on shares of Aimia from C$8.50 to C$9.50 and gave the company a “sector perform” rating in a report on Tuesday, February 21st. Finally, Royal Bank of Canada reaffirmed a “sector perform” rating and set a C$9.00 target price on shares of Aimia in a report on Tuesday, February 21st. Two analysts have rated the stock with a sell rating, five have issued a hold rating and one has issued a buy rating to the company’s stock. The company has an average rating of “Hold” and an average target price of C$7.03.

That was yesterday, May 15th. Today, a wave of these Sell Side analysts had a sudden change of heart after trying to hold out for days.

Based on today's closing price, Aimia has a dividend yield of 25.157%, that is if anyone believes it can continue to maintain the current payout. In plain English, this payout ratio cannot possibly be sustainable under any stretch of imagination. Remember that from a taxation view point, dividend payment from a qualified Canadian company is tax efficient. In theory, Aimia should be extremely attractive to a value and/or dividend investor. So clearly, this payout ratio cannot be maintained and why it won't be maintained is evidently a question of liquidity and future profitability. If dividend payout ratio needs to be drastically reduced or outright eliminated, then share prices will likely face further downward pressure even if at this point, the market has already factored the strong probability that such event may occur in the future - the market may not yet priced it in completely because no one knows for sure the magnitude or when it would take place.

This is not all that different to us here, wondering how long Aeroplan will remain afloat and whether the redemption tickets both on AC, *A and other airline partners will be protected in the event Aimia goes under. If and when Aimia eliminates its dividend payout entirely, it would signal to the market and to us, FFs and points collectors, that it's time to brace for impact and to those clinging on to "business as usual": Get your "behind" off the ship or sink with it!

#525

Suspended

Join Date: Mar 2017

Programs: AC

Posts: 2,167

Is there a list of Star Alliance partners that would get paid by Aimia only after a trip is made?

As per upthread, there is monthly reconciliation between Air Canada and Aeroplan.

Basically - should we be worried about our Aeroplan redemptions on non Air Canada airlines for travels not yet partaken given where Aimia's stock price is and a potential 'bankruptcy'?

As per upthread, there is monthly reconciliation between Air Canada and Aeroplan.

Basically - should we be worried about our Aeroplan redemptions on non Air Canada airlines for travels not yet partaken given where Aimia's stock price is and a potential 'bankruptcy'?