Master thread: CIBC Aeroplan credit cards

#331

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,765

Re churning, I figure it won't be long before they go the way of Amex and stop giving out sign-up bonuses to people who've had the card before.

#332

Join Date: Apr 2007

Location: Toronto, Ont., Canada

Programs: Aeroplan; Marriott Platinum; IHG Platinum; Best Western Diamond

Posts: 2,163

It's true CIBC hasn't been promoting the ae card much. They've been pushing their own Aventura card. TD is still pushing the ae card more than their own First Class card, which is actually much better than Aventura as the expediaforTD is a much better search engine and does give 4.5% return.

As for not giving bonus to stop churning, it's a calculation they need to make, because the flip side is they don't get those customers to come back. The older generation who don't shop around and stay with the existing cards, are getting older. The younger generation who are more comfortable with tech, do shop around.

As for not giving bonus to stop churning, it's a calculation they need to make, because the flip side is they don't get those customers to come back. The older generation who don't shop around and stay with the existing cards, are getting older. The younger generation who are more comfortable with tech, do shop around.

#333

Join Date: Jul 2016

Programs: Aeroplan Elite 35K

Posts: 102

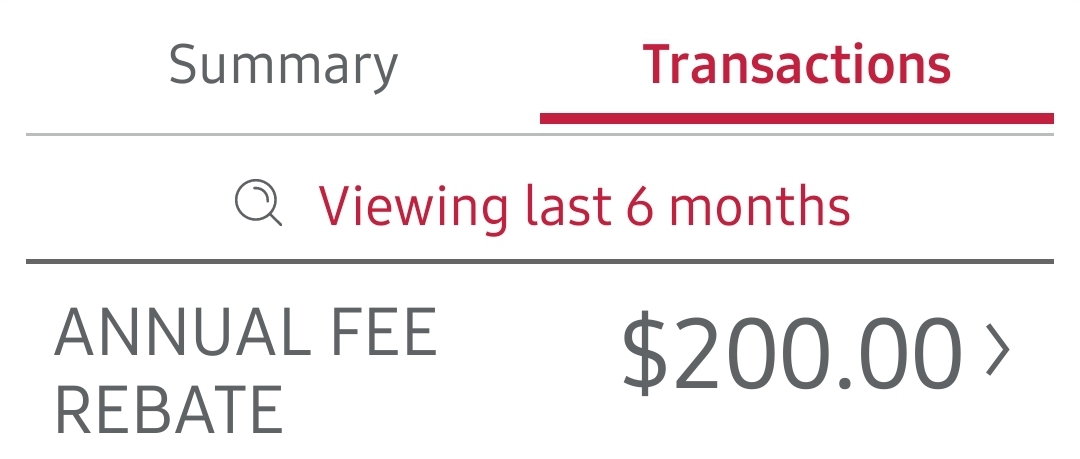

please share if this is true, spoke to couple CIBC FAs, none of them can even waive $399.

#334

Join Date: Jan 2008

Posts: 3,946

please let me know which CIBC branch could do this, more than happy to bring $200 K plus investment plus $800K mortgage from TD to CIBC, if any of the CIBC branch can waive the entire fee, even my TD FA will not be able to waive the entire annual fee.

please share if this is true, spoke to couple CIBC FAs, none of them can even waive $399.

please share if this is true, spoke to couple CIBC FAs, none of them can even waive $399.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.I may have mentioned here or maybe somewhere else, relationships (which I have had with branch managers and staff for multiple years), tenure on accounts (several years), maintaining certain balance, financial services (multiple mortgages, investments, etc.) may all have played a factor. Again relationships are important

.

.Someone also mentioned above receiving $139 on remaining $399 which netted to $260. I suggest you present your case and try and negotiate through.

#335

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,765

As for not giving bonus to stop churning, it's a calculation they need to make, because the flip side is they don't get those customers to come back. The older generation who don't shop around and stay with the existing cards, are getting older. The younger generation who are more comfortable with tech, do shop around.

But the reason Amex decided to fire the churners, if you will, was that they're not very good customers. The card issuers spend much of the initial annual fee on the welcome bonus. They make a little bit of margin on the relatively small minimum spend, and then people usually stop using the cards and cancel them before they pay another annual fee. Ultimately, they're not very profitable for the bank.

I'm one of the "younger generation" still, I think, and while my friends might be slightly quicker to change cards than my parents and their generation, they still typically use cards for a few years and only change when there's good reason to do so, e.g. fed up with not finding Aeroplan seats > switch to Avion. Once they leave a card, they don't typically go back, so eliminating sign-up bonuses for repeat cardholders probably doesn't make much of a dent in the number of long-term cardholders, i.e. the ones who rack up more charges on their cards, pay annual fees year after year, maybe carry a balance and pay some interest.

I could be wrong, but I just feel like CIBC's lack of enthusiasm for the Aeroplan cards means they might not want to bother with the churners anymore.

#337

Join Date: Feb 2011

Location: YXT

Programs: AC*E50, SPG Plat,

Posts: 575

I think your aeroplan # gets flagged as a cardholder (ie. its own type of status), so when checking a bag the system sees you as having the free bag. Just a guess since I haven't flown at all since I got the card (and have a free bag from status anyway). I seem to recall someone pointing out how a cardholder's boarding pass gets flagged as a cardholder just like *S/*G/E35/E50/etc get noted.

#338

Join Date: Jan 2008

Posts: 3,946

$99 Canada/US

$299 Sun destinations in Central America (including Hawaii)

$499 Europe, the Middle East, and Africa

$599 Asia, Australia and New Zealand

#339

Join Date: Apr 2007

Location: Toronto, Ont., Canada

Programs: Aeroplan; Marriott Platinum; IHG Platinum; Best Western Diamond

Posts: 2,163

Ah, that's a different offering than the buddy pass. If you can make good use of this worldwide companion pass, that in itself is worth the AF.

#340

Join Date: Feb 2006

Programs: AC75 MM

Posts: 959

Anyone have any insight as to whether there will be points conversion option for the worldwide companion pass?

#341

Join Date: Jul 2016

Programs: Aeroplan Elite 35K

Posts: 102

This isn't a published benefit so don't expect (or demand) to get a $399 credit even if you rollover $1m in mortgages (although CIBC may reward you $3k for the new mortgage  ). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

I may have mentioned here or maybe somewhere else, relationships (which I have had with branch managers and staff for multiple years), tenure on accounts (several years), maintaining certain balance, financial services (multiple mortgages, investments, etc.) may all have played a factor. Again relationships are important .

.

Someone also mentioned above receiving $139 on remaining $399 which netted to $260. I suggest you present your case and try and negotiate through.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.I may have mentioned here or maybe somewhere else, relationships (which I have had with branch managers and staff for multiple years), tenure on accounts (several years), maintaining certain balance, financial services (multiple mortgages, investments, etc.) may all have played a factor. Again relationships are important

.

.Someone also mentioned above receiving $139 on remaining $399 which netted to $260. I suggest you present your case and try and negotiate through.

#342

Join Date: Jan 2008

Posts: 3,946

This isn't a published benefit so don't expect (or demand) to get a $399 credit even if you rollover $1m in mortgages (although CIBC may reward you $3k for the new mortgage  ). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.

). If you are going to transfer a $800k mortgage and $200k in investments strictly to get a $399 additional rebate, then I suggest you re-evaluate your financial priorities.I may have mentioned here or maybe somewhere else, relationships (which I have had with branch managers and staff for multiple years), tenure on accounts (several years), maintaining certain balance, financial services (multiple mortgages, investments, etc.) may all have played a factor. Again relationships are important

.

.Someone also mentioned above receiving $139 on remaining $399 which netted to $260. I suggest you present your case and try and negotiate through.

So that's a total $3300. You need to weigh the overall benefits vs. your existing business at TD.

Good luck

#343

Join Date: May 2006

Location: YYZ

Programs: AC SE, UA Silver, Bonvoy LT Titanium, Accor Diamond, Hilton Gold

Posts: 415

Has anyone noticed that they are no longer getting their SQM and SQS status qualification boosts for their credit cards? Looks like I received the proper SQM/SQS posting from my CIBC Aeroplan Infinite last month, but not on the credit card statement from a couple of days ago. I wonder if this is a new bug that has appeared as part of the EDQ roll-out as I am now receiving those.

#344

Moderator, Air Canada; FlyerTalk Evangelist

Join Date: Feb 2015

Location: YYC

Programs: AC SE MM, FB Plat, WS Plat, BA Silver, DL GM, Marriott Plat, Hilton Gold, Accor Silver

Posts: 16,765

Has anyone noticed that they are no longer getting their SQM and SQS status qualification boosts for their credit cards? Looks like I received the proper SQM/SQS posting from my CIBC Aeroplan Infinite last month, but not on the credit card statement from a couple of days ago. I wonder if this is a new bug that has appeared as part of the EDQ roll-out as I am now receiving those.