United Airlines Adds Second MileagePlus Funding Round

United Airlines is adding to its previous fundraising rounds through offering senior secured notes. The Chicago-based airline is once again drawing from the MileagePlus program, giving flyers even more insight into how the loyalty scheme works.

United Airlines is once again drawing from the MileagePlus program to raise funds, with the goal of improving liquidity as they enter the summer months. In their latest filing, United is offering senior secured notes for sale through its frequent flyer program holding companies.

United Offers Notes Through MileagePlus Subsidiaries

Previously, United announced they would draw a $5 billion line of credit using the MileagePlus program as collateral, effectively monetizing their user data. Under their next fundraising round, the Chicago-based carrier will offer senior secured notes through their subsidiaries Mileage Plus Holdings, LLC, and Mileage Plus Intellectual Property Assets, Ltd.

The private sale will be offered to “eligible purchasers” identified by the airline. The notes will come due in 2027, and will be guaranteed by the MileagePlus subsidiaries and United Airlines Holdings. In turn, the subsidiaries will “lend the net proceeds from the offering of the Notes to United,” after some of the funds are deposited in a reserve account.

MileagePlus Earns $5 Billion Cash Flow From Selling Miles

In an 8-K filing with the U.S. Securities and Exchange Commission, United pulled back the financials for the MileagePlus program, justifying their senior secured notes offering. In 2019, the program had a net income of $1.578 billion. In the 12-month period ending Mar. 31, 2020, MileagePlus warned $1.46 billion in sales of miles to United, but made nearly $4 billion selling miles to third parties.

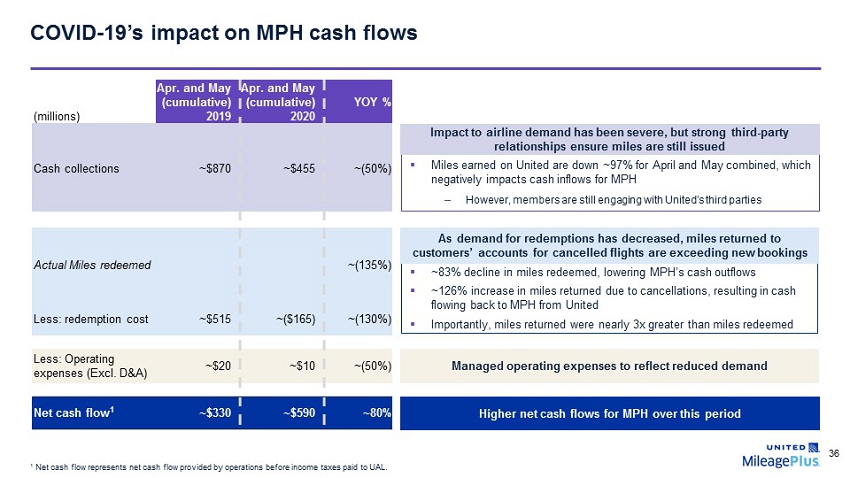

During that same 12-month period ending in March, MileagePlus had a net income of $1.6 billion, with over $12 billion in assets. However, the COVID-19 pandemic has put a damper on cash flows, as fewer flyers are earning and burning miles. Compared to April and May 2019, the MileagePlus program has collected 50 percent less cash from selling miles, which impacts their cash flow. Miles redeemed dropped by 135 percent, and cancellations forced United to pay back MileagePlus for tickets redeemed. According to United, miles returned to flyers were around three-times greater than those redeemed.

A slide from United’s 8-K filing shows the current state of MileagePlus cash flow in the face of the COVID-19 pandemic. Courtesy: United Airlines

United says they plan on having $17 billion in available liquidity by September 2020. In addition to the fundraising rounds, the airline is preparing to take the full $4.5 billion in loans from the CARES Act. Despite this, the airline expects to burn an average of $40 million daily through the second quarter of 2020.

American Reportedly Adds to Fundraising Rounds

United isn’t the only airline looking to add liquidity to their bottom line. American is also increasing their latest fundraising round to nearly $2 billion, adding an additional $500 million in stock and convertible notes.

In a press release, American confirmed they would sell stock at $13.50 per share, a nearly $1.50 discount per share compared to its closing price on Monday, June 22. In addition, qualified shareholders will be able to convert their stock into convertible notes at a rate of approximately $16.20 per share, reflecting an increase of 20 percent compared to the stock offering.

Q2 is over, would be great to report what their expected cash burn rate for Q3 is.

Has nothing to do with the subject, does it? Get a life!

Секрет евреев: Еврейские мужчины лечат простатит за 2-3 недели! Один раз в жизни! Раз и навсегда! Узнаем как... https://txxzdxru.diarymaria.com/