Study: Ultra-Low-Cost Carriers Drive Revenue Through Ancillary Fees

The ultra-low-cost carriers are notorious for their ancillary fee dependency – but how much of their revenue comes from add-on fees? According to a new report from Ideaworks, both Spirit Airlines and Allegiant Air made nearly half of their total revenue from ancillary fees.

America’s ultra-low-cost carriers – Allegiant Air, Frontier Airlines and Spirit Airlines – are notorious for their dependence on ancillary fees to offset their low airfare costs. But a new report from Ideaworks shows just how much they depend on all the add-ons to keep their bottom line afloat. The 2020 CarTrawler Yearbook of Ancillary Revenue shows all three make up nearly half of their revenue through everything from additional luggage to seat selection fees.

Ultra-Low-Cost Carriers Get Nearly Half of Revenue From Ancillary Fees

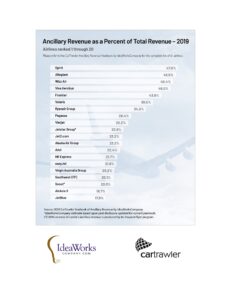

According to the Ideaworks report, Spirit lead all airlines globally from ancillary revenue as a percentage of their total revenue in 2019. The Florida-based airline earned 47 percent of their total revenue through all the add-ons offered to flyers. Las Vegas’ Allegiant Air came in a close second, earning 46.5 percent of their total revenue through ancillary fees. Frontier came in fifth worldwide, deriving 43.6 percent of total revenue from the add-ons.

For comparison purposes, Ryanair only earns 34.5 percent of their total revenue from ancillary fees. EasyJet’s haul from ancillary fees is even lower, with ancillaries contributing 21.6 percent.

Among the larger American carriers, Alaska Airlines ancillary fee structure made up 23.2 percent of their total 2019 revenue, making them the biggest. Southwest Airlines’ collected 20.1 percent in ancillary fees, but the report notes 80 percent of that number was driven from the Rapid Rewards loyalty program.

Although the legacy three’s ancillary fee haul only contributed between 13.6 and 16.2 percent to their total bottom line, they outpaced the entire field in the total amount collected from flyers. American Airlines earned $7.4 billion from ancillary fees in 2019, United earned $6.58 billion from extras, and Delta earned $6.198 billion through ancillary sales.

Despite Low Projections, Ancillary Fees Could Help Airlines Recover

Because flyers have not been traveling due to the COVID-19 pandemic, this year’s ancillary fee revenue is expected to be significantly less. The analysts project the airlines will collect roughly half of what they earned in 2019 from ancillary fees, which will undoubtedly hurt the bottom line.

But for airlines that depend heavily on the extras, those fees could be what helps them recover into 2021 and beyond. Earlier this year, Spirit boldly predicted they would be the first airline to return to profitability because of their ancillary fee structure, while expanding their loyalty program to target flyers with lower income and sub-prime credit.

Keep in mind that these fees are not taxed unlike the base fare. Less for the gov’t and more for the shareholder’s pockets.