Last edit by: WineCountryUA

Potential reasons for high fares

-- the lower fare classes are sold out

-- the lower fare classes are not available due to fare rule restrictions

..... day of the week travel restrictions, Saturday night stay requirement, minimum stay requirement, advance purchase requirements, ...

-- desired fares are not combinable

-- discount fares not available for one-ways, only roundtrips Why are international OWs so expensive, such high fare classes?

-- discount inventory for codeshare marketing airline is gone, but flight operator may have discount fare (or the reverse)

-- Plating -- airlines restrict the best fare to their ticket stock, meaning ticketing that flight on another ticket stock will be more expensive

-- Airline is figuring it will still sell (due to last minute purchases0 even if the competition is lower earlier. Such as peak leisure periods or special events.

-- Airline is placing a premium on non-stop (monopoly?) versus alternative connecting routings

If you find an expensive flight, start by checking the fare class and compare to the less expensive option -- that generally will explain a lot.

Archive thread

-- the lower fare classes are sold out

-- the lower fare classes are not available due to fare rule restrictions

..... day of the week travel restrictions, Saturday night stay requirement, minimum stay requirement, advance purchase requirements, ...

-- desired fares are not combinable

-- discount fares not available for one-ways, only roundtrips Why are international OWs so expensive, such high fare classes?

-- discount inventory for codeshare marketing airline is gone, but flight operator may have discount fare (or the reverse)

-- Plating -- airlines restrict the best fare to their ticket stock, meaning ticketing that flight on another ticket stock will be more expensive

-- Airline is figuring it will still sell (due to last minute purchases0 even if the competition is lower earlier. Such as peak leisure periods or special events.

-- Airline is placing a premium on non-stop (monopoly?) versus alternative connecting routings

If you find an expensive flight, start by checking the fare class and compare to the less expensive option -- that generally will explain a lot.

Archive thread

Consolidated "Why is this UA fare so expensive?" thread

#46

FlyerTalk Evangelist

Join Date: Aug 2017

Programs: AS 75K, DL Silver, UA Platinum, Hilton Gold, Hyatt Discoverist, Marriott Platinum + LT Gold

Posts: 10,466

This article on advance purchase timing seems like the best analysis I've found so far: https://www.cheapair.com/blog/the-be...o-buy-flights/ ... they found that 21 to 127 days in advance is optimal, with really the middle of that window being the best.

United has way enough data points to interpret the buying behavior of the general public. Most people buying far out tend to have inflexible dates, and usually around major holidays and popular destinations, so why open/file discounted/deep discounted fare buckets?

#47

Join Date: Aug 2011

Programs: UA 1K | Marriott LT Platinum

Posts: 459

I've seen every combination: flights that get cheaper close in, flights that only get more expensive close to departure, event-driven flights that only got more expensive until the week before and then unexpectedly dropped in price (which is when it's great to take advantage of the 'no change fee' policy and get some money back), etc. The only time I look super far out is to see if there's saver availability and book speculatively.

The US majors definitely have very different approaches to fare pricing (though that doesn't mean they won't move in concert on any given route for competitive purposes). My personal take, fwiw, is that UA is the most sophisticated (by a fairly large margin) and AA just makes one bone-headed mistake after another.

#48

Join Date: Apr 2016

Location: BNA (Nashville)

Programs: HH Diamond

Posts: 6,225

I'm in the process of planning out about 10 trips for June-Dec this year and have noticed that for every international route I look at, United is 2x (or more) the price of American or Delta for direct fights and sometimes up to 3x the price when there is a single stop on the way in discount business class. All from LAX. Destinations like St. Thomas (not technically international?), London, Sydney, Tokyo, Geneva, Rio.

Additionally, everything is waitlisted for PlusPoint upgrades (no skip waitlist), and when I look at points pricing it is 200k-300k points EACH WAY for LAX-IAD-STT or LAX-IAH-STT... which seems crazy for 737 seats on a plane that is completely empty. Additionally, zero availability in saver fares (IN) or PZ that I could use a GS.

It is starting to feel like United cranked the dial a little too hard this year. As a GS, I'm really trying to stay loyal to United, but this pricing is making it really hard to justify.

Additionally, everything is waitlisted for PlusPoint upgrades (no skip waitlist), and when I look at points pricing it is 200k-300k points EACH WAY for LAX-IAD-STT or LAX-IAH-STT... which seems crazy for 737 seats on a plane that is completely empty. Additionally, zero availability in saver fares (IN) or PZ that I could use a GS.

It is starting to feel like United cranked the dial a little too hard this year. As a GS, I'm really trying to stay loyal to United, but this pricing is making it really hard to justify.

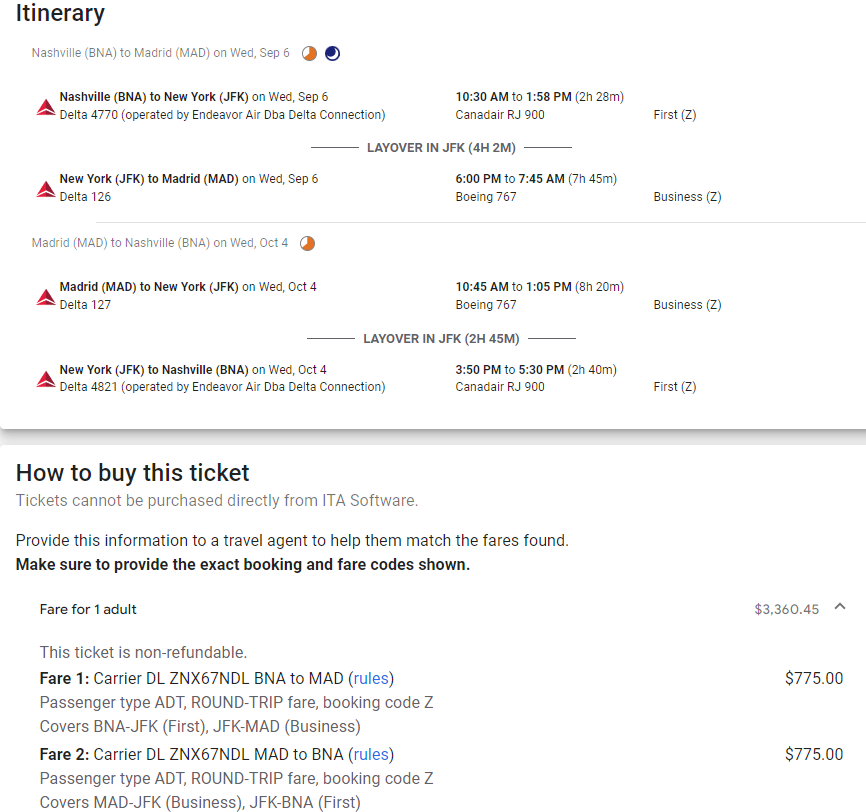

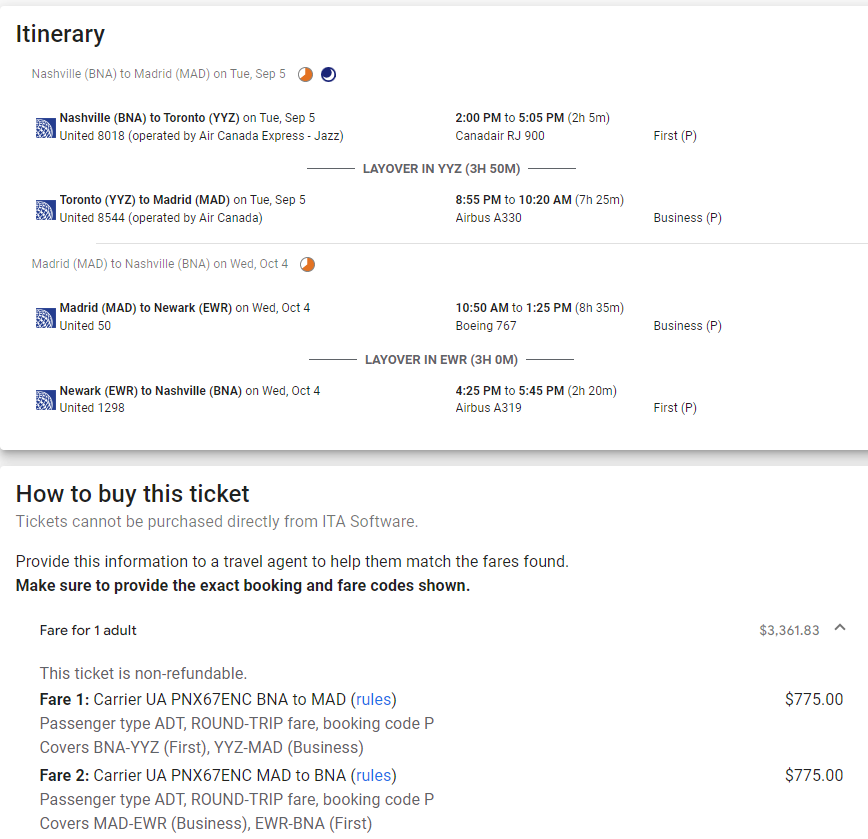

I am pricing BNA - MAD in J in September 7, return October 4:

UA: Some at $3300, most at $3800, a couple at $5,500

DL: Almost all at $5,700

AA: every combo on the app shows $11,700 - $11,900 but one that is $5,500.

The same AA/BA combo of flights on the BA website price at $4400.

I just checked the website instead of the app and AA pricing are all $11,900.

How can they all be so different?

#49

Join Date: Oct 2002

Location: SFO

Programs: A few here and there

Posts: 207

My take

So I’ve experienced this over the last year since travel has begun to cold back. I believe united has no motivation to offer cheaper fares as planes are booked solid with limited capacity

the other issue is this. With no change fees just book the flight. If it comes down closer to departure just change the flight or cancel and use the travel credit to rebook. I’ve done this about 10 times in ve the past year. With the removal of change fees I think it’s completely thrown their revenue model into a new world

the other issue is this. With no change fees just book the flight. If it comes down closer to departure just change the flight or cancel and use the travel credit to rebook. I’ve done this about 10 times in ve the past year. With the removal of change fees I think it’s completely thrown their revenue model into a new world

#50

Join Date: Jan 2010

Location: LAS, ZQN

Programs: UA PP (2MM), BA gold

Posts: 2,195

If you are based in LAX, try looking at flights out of SFO as well, and then tacking on a short repositioning flight. For example, there was the $2.2k SFO-FCO R/T J fare a few months ago, but nothing similar out of LAX. On the topic of award flights, I've never booked an award that wasn't at a saver rate, so keep looking I guess?

I am in YVR now after flying back on KLM. Bought a YVR-AMS-YVR almost a year ago to position up north.

You just need to grab things as you see them if you are flexible.

I think the Award pricing nuts but considering the devaluations all airlines have had they see the need to charge more miles.

Have to hope the JN deals come back.

#51

Join Date: Mar 2003

Location: Los Angeles, CA

Programs: UA 1K 1MMer & LT UC (when flying UA); Hyatt Credit Cardist; HHonors Diamond; Marriott Gold via UA 1K

Posts: 6,956

I’ve been monitoring LAX-JNB flights at the end of August. For the flights I want to take, UA wants over $15K.

#52

Join Date: Jun 2014

Programs: UA MM

Posts: 4,107

I'm not sure I know what you mean by "just need to find it" wrt pricing. If you need or want to go to Paris (just as an example) then finding a great fare to Rome is irrelevant.

#53

Join Date: Jun 2014

Programs: UA MM

Posts: 4,107

....

Because DL and AA aren't as bullish as UA is, which AA/DL's decisions are also reflected in their financials. And as much as people want to say UA's success is due to death of the product by a thousand "Kirby Kuts", TRASM doesn't grow by 26% because of cutting the product. I don't think many people are interested in following AA's example right now when it comes to pricing decisions.

Because DL and AA aren't as bullish as UA is, which AA/DL's decisions are also reflected in their financials. And as much as people want to say UA's success is due to death of the product by a thousand "Kirby Kuts", TRASM doesn't grow by 26% because of cutting the product. I don't think many people are interested in following AA's example right now when it comes to pricing decisions.

UA $1.39B

DL $1.43B

DL was slightly ahead in Q3, too

#54

Join Date: Jan 2011

Location: Washington, D.C.

Programs: AA, but I play the field

Posts: 1,440

I'm spending a lot of time on the AA forum lately and there's lots of complaining how expensive fares are, as well as about lack of international award space. I haven't looked but I would bet money that the same is true on the DL forum. (And don't get me started on Qantas . . . ) I'm not doubting the OP's experience at all, but my sense is that demand is currently high on all the major airlines, and which one you find to be more affordable will likely depend on the specific routes, timeframes, etc. that you are looking at.

#55

Join Date: Feb 2017

Location: Austin, TX

Programs: BAEC Gold, HHonors Diamond, Marriott Titanium, UA Gold (*G), DL Silver, Makers Mark Ambassador

Posts: 4,635

Demand is high and pilots (and therefore available seats) are scarce. Hope we see it start to come down soon but, UA does seem to be drastically higher than AA, which is facing the same pressures.

#56

FlyerTalk Evangelist

Join Date: Sep 2003

Location: Honolulu Harbor

Programs: UA 1K

Posts: 15,004

Why is UA more expensive than others? Just different revenue management. I’m pretty sure UA is aware of the price differentials (and may eventually text) but I think UA believes (as each airlines does) that they are doing it right. Day-to-day differences far out on a particular flight when demand is low aren’t as important as what happens closer to the flight when most of the seats start to sell. To put it another way, UA doesn't care if they hook some or lose some far in advance - the bulk of the revenue they’re looking for will be closer to departure. Lower fares are generally a part of that later overall revenue management scheme.

With the drop of change fees, exchanging early-bought tickets for cheaper trips is now a game, but the added cost is one’s time in keeping track of (sometimes numerous) credits. I sort of figure UA’s flight credit scheme has resulted in some loyalty to UA (they are holding a lot of credits for people

) - that probably makes up for change fee drop. People buy new tickets. Or the credits expires unused.

) - that probably makes up for change fee drop. People buy new tickets. Or the credits expires unused.

Last edited by IAH-OIL-TRASH; Jan 23, 2023 at 11:17 pm

#57

Join Date: Jul 2015

Location: San Francisco

Programs: UA MM Plat, UA 1MM, Hilton Lifetime Gold, Marriott Gold, Hertz Gold, CLEAR, AS MVP Gold

Posts: 3,614

If you are based in LAX, try looking at flights out of SFO as well, and then tacking on a short repositioning flight. For example, there was the $2.2k SFO-FCO R/T J fare a few months ago, but nothing similar out of LAX. On the topic of award flights, I've never booked an award that wasn't at a saver rate, so keep looking I guess?

#58

Join Date: Sep 2003

Location: LAX

Programs: UA MM | BA Silver

Posts: 7,192

When booking 1-4 weeks in advance UA is more competitive. I’m looking at LAX-MCO vv in June and UA is astronomical (as is DL in C+). I wouldn’t normally book this early but I have no flexibility, which the airlines are counting on. Ended up booking MCO-LAX on B6 this week. Three seats + Even More Space upgrades was several hundred dollars cheaper than UA (and we get E+ for free). I’m waiting to see what happens with pricing on the outbound. Fingers crossed it drops on UA or DL.

#59

FlyerTalk Evangelist

Join Date: Jul 2003

Posts: 23,021

I just saw the opposite:

I am pricing BNA - MAD in J in September 7, return October 4:

UA: Some at $3300, most at $3800, a couple at $5,500

DL: Almost all at $5,700

AA: every combo on the app shows $11,700 - $11,900 but one that is $5,500.

The same AA/BA combo of flights on the BA website price at $4400.

I just checked the website instead of the app and AA pricing are all $11,900.

How can they all be so different?

I am pricing BNA - MAD in J in September 7, return October 4:

UA: Some at $3300, most at $3800, a couple at $5,500

DL: Almost all at $5,700

AA: every combo on the app shows $11,700 - $11,900 but one that is $5,500.

The same AA/BA combo of flights on the BA website price at $4400.

I just checked the website instead of the app and AA pricing are all $11,900.

How can they all be so different?

Last edited by xliioper; Jan 24, 2023 at 5:58 am

#60

FlyerTalk Evangelist

Join Date: Aug 2005

Location: BOS/EAP

Programs: UA 1K, MR LTT, HH Dia, Amex Plat

Posts: 31,978