Last edit by: philemer

Posts from 1/1/16 onward can be found here: http://www.flyertalk.com/forum/credit-card-programs/1739359-2016-onward-usa-emv-cards-availability-q-chip-pin-signature.html

EMV wikipost volunteers: kebosabi

What is EMV?

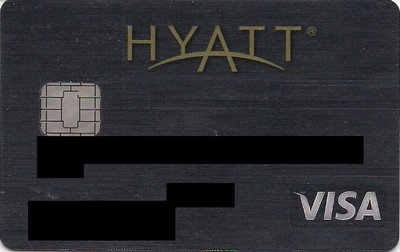

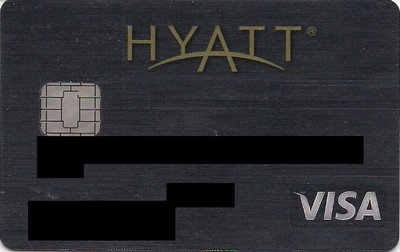

EMV is a defacto global standard of technology where there is a visible microchip on the front of the card. It looks like this:

Who issues them?

See Google Docs spreadsheet in Post #1

SFOAMS also has created a list of excellent webpage that shows US EMV cards in a more interactive interface

Another site, which lets you narrow the search for an EMV card by various parameters, is http://www.spotterswiki.com/emv/index.php.

Several credit unions issue some form of Chip-and-PIN credit cards or prepaid cards. Prepaid EMV cards however are not recommended due to junk fees. USAA (currently restricted to members of military) used to offer Chip-and-PIN cards, but as late has backtracked to Chip-and-Signature priority.

Hey that's a cool Google Docs list! I know others that aren't on that list. How can I help by adding them to the list?

My bad for not putting this into the wiki sooner. Right now, the Google Docs is locked out of editing and only in "read-only" view because there were instances in the past where people would just delete the rows not thinking that it affects others viewing the list.

If you promise not to delete any rows and input all the pertinent info (annual fee, rewards, FTF, etc.), I can provide you with edit access. Just shoot me a PM to kebosabi with your gmail address and I'll provide you edit access.

Thanks for helping out!

As of October 2014, no USA-based card issuer offers Chip-and-PIN priority cards except for BMO Harris (Diners Club) and UN Federal Credit Union. Other major USA-based banks such as BofA, Chase, Citi, as well as others issue Chip-and-Signature cards which may work at many automated kiosks. However, bear in mind the word may is used above is a context where there is no absolute certainty of success for certain environments such as automated kiosks due to different natures of offline and online transactions. It is highly recommended to read Post #3 which lists real life FTer examples on how Chip-and-Signature worked and did not work at various transaction environments.

Can I upgrade it right now?

If it's listed on that Google Docs spreadsheet or SFOAMS' Silk page, wouldn't hurt to call/twitter them for a free upgrade. If you get the response you don't like, hang up, try again.

What is the difference between Chip-and-Signature and Chip-and-PIN?

You insert the chipped card into the slot. The physical contact terminal will read the EMV chip and the terminal will automatically read the preferred cardholder verification methods (called CVM) for that card.

Chip-and-Signature means that the terminal will printout a receipt for you to sign. This is the most prevalent authentication for most US issued EMV cards. Chip-and-Signature helps in a way that it will get through to face-to-face merchant transactions where you and the merchant do not speak the same language.

Chip-and-PIN means that the terminal will prompt you to input a PIN for authentication. Some credit union issued credit cards will have this CVM as secondary if Chip-and-Signature cannot be done. Chip-and-PIN is the more prevalent method of authentication used outside the US, especially in transaction environments where no human interaction is needed (i.e. automated gas pumps, toll roads, train kiosks, etc.).

The Google Docs spreadsheet will list which CVM are used in the EMV cards listed. Some cards can only do Chip-and-Signature. Other cards can do both Chip-and-Signature and Chip-and-PIN. And others might have a third option called No CVM (no authentication needed) which is reserved for low value transactions.

One chip can hold a lot more data, therefore it is capable of doing multiple verification methods. That's one of the great things about EMV over the mag-stripe which can hold very little data.

I want to know for sure what my EMV chip does. Is there anyway I can test out my own EMV card to see what the CVM list is?

alexmt has written up a nice step-by-step procedure on Post #3615.

If most of the EMV cards in the US is the Chip-and-Signature type, doesn't that mean it's still useless abroad?

Depends if you see it as glass half empty or glass half full. See Post #3 for further details on how Chip-and-Signature has worked both successfully and unsuccessfully depending on the merchant transaction environment and use your best judgment whether which one is right for you.

Are there any places in the US that are accepting transactions via the EMV chip?

tmiw has created a dedicated Google maps webpage to show where EMV has been proven to work here: http://emvacceptedhere.com/ Per his Post #4240, feel free to add any places with active EMV terminals if you come across one.

As of 2014/05, the EMV terminals in most Walmarts and Sam's Clubs are being turned on. Hence, the best place to try them out would be your local Walmart or Sam's Club. For other merchants, it's slowly being phased in.

I hope people will post them in the Post your receipt of your 1st EMV based transaction in the US thread. cvarming has shown us an EMV transaction receipt from Brooklyn, NY in Post #2380. I myself had my first EMV based (Chip-and-Signature) transaction in two stores in the Los Angeles area, as shown in detail in Post #2705 (courtesy of WhatWhatTech for pointing these two stores out)

I don't want a chip in my card. I heard horror stories all over the media saying hackers can steal my credit card info from a mile away.

There are two types of chips. One is contactless and the other is contact. Cards can be either one or the other, or both.

In the Google Docs spreadsheet, the cards that are capable of contactless payments are listed seperately under the "RFID or NFC contactless chip" column. If it says yes, then that means it has the ability to do contactless payments. If it says no, it doesn't have that feature.

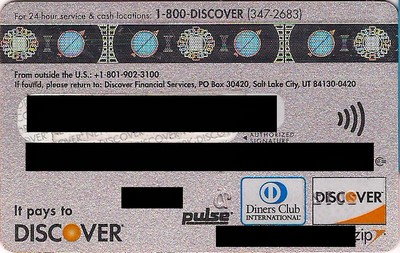

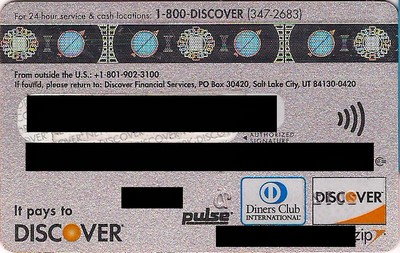

The one that the media has overhyped about hackers "stealing your information wirelessly" was the contactless type like this:

You are worried about this happening, right?

You don't have to worry. EMV is a chip standard that can have both contact and contactless interfaces. With the traditional contact interface, this means you actually have to physically insert the chip into a POS terminal for it to be authorized, like this:

With the contact interface, nothing is wireless. No data is sent out in a stand-alone contact type EMV chip. With the EMV contactless interface, data is sent wirelessly.

Furthermore, contactless chip cards are required to show a symbol (looks like Wi-Fi symbol) somewhere on the card that to denote it's capability as a contactless card. For example, here's an example of a Discover Card with contactless capability (in which Discover calls "Discover ZIP") showing the contactless symbol on the back of the card:

Don't believe everything that the media says. Besides, millions of people all over the world from London to Singapore, uses contactless payments daily in extremely crowded subways and mass transit with nary any problems. There are multiple layers of encrypted securities and keys that are needed to break the code.

Frankly, giving your physical card to a waiter/waitress who takes the card out of your view is much more susceptible to fraud than contactless payments.

Why should I care?

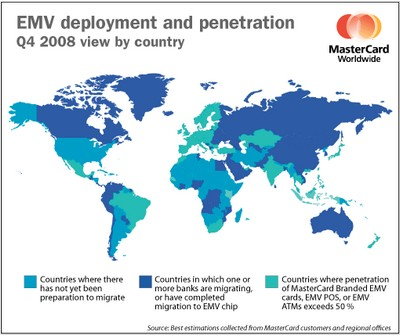

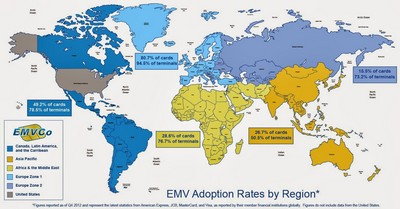

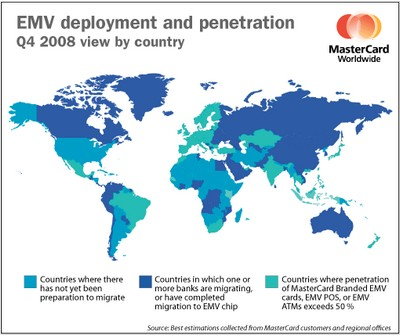

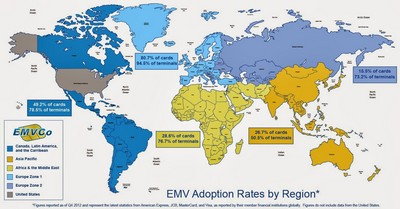

If you are an international traveler, you will want this because majority of the world has or in the process of converting to this payment format.

In fact, in 2012, even North Korea moved to the EMV format, leaving the US as one of the countries in the world that hasn't done so.

In addition, VISA, MC, AMEX, and Discover have all agreed to incentivize the USA shifting to EMV payments by 2015 by shifting liability for fraudulent transactions to merchants if they do not have EMV equipment and the cardholder has an EMV card. So if you travel internationally or would like to get one before the others, you might be interested in getting one.

BS! I had no problems using my card in [insert whereever country], [insert whatever point in time]

If you stick to the tourist path where they have lots of visitors from the US, you should have no problems using your mag-stripe only card in hotels and restaurants, at least for now. But as things can change as things go forward.

However, consider that once you start taking the off-beaten path, go to non-touristy places where they are not familiar with mag-stripes, rent a car and use toll roads, fill up gas, or try to buy train tickets you might end up into a trouble of the machine not recognizing your card because it lacks the chip. Furthermore, a lot of toll roads, gas pumps, and automated ticket machines lack any human assistance to help you when you need it the most.

But [insert credit card company] told me all merchants that display their logo must accept them! All I have to do is report them for violating their agreements, right?

There are several factors against this.

1. You can only speak English. The merchant representative, most likely a part-time clerk earning minimum wage, speaks in a different language, let's say French. If you have no French language skills, how are you going to get your point across? Are you going to whip out your cell phone at exorbitant int'l roaming charges and hope the customer service is going to translate it for you on the spot? Or maybe you might actually know French. But how about Swahili, Farsi, Balinese, or the multiple languages in mainland China?

2. Just like US, the rest of the world's businesses uses part-time minimum wage workers as cashiers to cut down on labor costs. Most of their SOP training manuals are written by MBA types to not to do anything they are not familiar with. Do not expect them to understand the intricate details of credit card mumbo jumbo. You don't expect Taco Bell employees to understand the minute details of Discover-JCB-Union Pay agreements, right? Same thing the other way around: be respectful as a guest in their country, prepare in advance in their ways, avoid being an "ugly American" stereotype.

3. You are a guest in their country. You are a minority. If 99.9% of their country's people and other tourists from around the world uses EMV, do you really think they are going to accomodate the 0.1% of American tourists who only have mag-stripes credit cards?

4. Again, you are a guest in their country. How would you, as an American standing in line, react if a Chinese tourist was clogging up the lines at a local Taco Bell because the clerk doesn't understand the Discover-Union Pay agreement and has trouble communicating between Mandarin spoken by the tourist and English spoken by the Taco Bell clerk? Same way the other way around. You do not want to clog up the lines for everyone. The less hassle, the better.

5. VISA and MC make tons of money from merchants in that country. Say SNCF French Rail. It's a billion dollar company in France. Do you think VISA is going to pull the plug of their relationship with SNCF because SNCF refuses to do mag-stripe processing at their unmanned train station kiosk? Of course not. Be realistic.

6. And lastly, if you're up against an unstaffed toll kiosk, gas pump or train ticket machine, are you going to yell curses at the machine?

But I want my credit card to be able to be used in the US too!

No worries. They have not gotten rid of the mag-stripe on the back of the card for backward compatibility reasons, just like we still have embossed numbers on our cards for backwards compatibility to using those old carbon copy imprinters.

[insert own Hyatt card image front and back together with red arrows pointing to all the backward compatibility features]

You use the chip on the front of the card abroad (for now), and the mag-stripe just like any other card for the US. Basically, you're increasing your credit card's acceptance rate by getting a card that both via the chip and the mag-stripe. You're getting a better deal for free.

And when 2015 comes along and US switches to EMV, you'll be way ahead of everyone else too!

So why did the rest of the world and the US moved/moving toward EMV?

Primarily, due to fraud concerns. You see, the mag-stripe has been with us since the 1950s. It may have been the most high tech thing back in the day, but with the technology that is available today, any shmo can pick up a $100 USB magnetic card skimming device off of eBay and get your credit card info.

And unlike skimming off contactless cards which actually need the person to have l33t programming skills, skimming off a magnetic stripe has become so ubiquitous that nary a day goes about skimming fraud going on somewhere in America, from gas pumps, Michael's stores (2011), Target breaches (2013), restaurant waiters/waitresses, to even McDonald's drive thrus.

https://www.google.com/search?q=skimming+fraud

These type of fraud used to be prevalent in Europe. But once they started switching over to EMV starting over 2 decades ago, this type of fraud went elsewhere. It went over to Asia, Canada and Mexico, Latin America, etc. etc. until they too began implementing EMV to combat skimming fraud. The US is practically the only country left that hasn't done so, therefore all the fraud that used to take place elsewhere is now happening here.

But EMV is old and it's not fool proof. Shouldn't we just skip over it and do something new instead?

Yes, EMV is old. It was developed in the 1990s and its smart card payment predecessor was first introduced in France. But as of today, it has become the defacto global standard of payments.

But then, what else is there? There is no other de facto global standard of payments alternative. For example, if we decide to skip over it and do something new, hypothetically like DNA matching technology, it still means US int'l travelers will continue to have problems abroad with useless plastic acceptance because no other country is using this DNA matching technology except the US.

Besides, nothing is fool proof. You can say that the bank vault isn't fool proof because you can crack it open if enough C4 is used. But your average low-life scumbag isn't likely to get military grade C4 easily either. But the bank vault does make it harder to get the bank's money over say a petty cash box. That's the point here. EMV is akin to a security tight bank vault, the old mag-stripe is akin to a petty cash box lying around inside the drawer.

I'm a business owner and I don't think EMV is going to take off. I'm not going to spend extra hundreds of dollars to upgrade my credit card machine. Convince me other wise why I should.

I can understand the added extra cost to your business once this switchover takes place. But before even saying that, look at your existing POS terminal. Does it have a slot somewhere to insert a card?

Most likely, if you had replaced your POS terminal within the past five years, you already have an EMV capable terminal. EMV is basically just not turned on yet from the processor and acquirer side.

If you have an EMV capable terminal, then a best bet would be to contact your acquirer to have the EMV feature turned on. You did your end of the deal already by having an EMV capable terminal, it is now the acquirers' responsibility to turn it on in accordance to the EMV switchover mandate.

And if you don't, you are going to replace your POS terminal anyway from common wear and tear. It isn't a hard switch-over. You can continue to use your POS terminal until it dies out because EMV cardholders will still have the mag-stripe on the back. And by the time your non-EMV capable POS terminal is up for replacement the market will be full with these newer POS terminals that can accept the mag-stripe, EMV, as well as contactless payments.

In addition, you may also want to check with your acquirer or processor about EMV capable terminals. Some of them are willing to replace your terminal for free in preparation for the US EMV switchover. Call and ask for details.

But what's in it for me? I'm the one that has to pay for the upgrade.

All the major card networks have given incentives for merchants for the upcoming EMV switchover.

If 75% or more of your credit card transactions are done on an EMV contact and contactless terminal, they are going to waive your annual PCI-DSS fees, which usually costs you around $5.00-$19.95/month per terminal. The overall long term cost savings of those compliance fees will be larger than the cost of an one time upgrade for the terminal.

The downside is that once EMV switchover happens and if you do not have a POS terminal that is able to accept EMV, the fraud liability shifts over to the merchant.

I own several fast food franchises. If I upgrade my POS terminals at all of my restaurants, it's going to cost me thousands, if not millions. I don't think anyone is going to use a fake credit card to buy $5 burgers. And if they do, wouldn't it be cheaper for me to eat the fraud cost?

Remember also that fraud isn't just committed by dishonest customers using fraudulent cards. Fraud can also happen with dishonest employees skimming off credit card data from the mag-stripe as in the case of a teenage McDonald's drive thru employee skimming off $13,000 of customers' credit cards in Olympia, WA. Consider the public relations fall out that your business may have if this happens (i.e. the big Target breach of 2013, where someone used a mag stripe card to load malware INTO Target's system). Is it worth risking to take such a huge PR disaster?

EMV wikipost volunteers: kebosabi

What is EMV?

EMV is a defacto global standard of technology where there is a visible microchip on the front of the card. It looks like this:

Who issues them?

See Google Docs spreadsheet in Post #1

SFOAMS also has created a list of excellent webpage that shows US EMV cards in a more interactive interface

Another site, which lets you narrow the search for an EMV card by various parameters, is http://www.spotterswiki.com/emv/index.php.

Several credit unions issue some form of Chip-and-PIN credit cards or prepaid cards. Prepaid EMV cards however are not recommended due to junk fees. USAA (currently restricted to members of military) used to offer Chip-and-PIN cards, but as late has backtracked to Chip-and-Signature priority.

Hey that's a cool Google Docs list! I know others that aren't on that list. How can I help by adding them to the list?

My bad for not putting this into the wiki sooner. Right now, the Google Docs is locked out of editing and only in "read-only" view because there were instances in the past where people would just delete the rows not thinking that it affects others viewing the list.

If you promise not to delete any rows and input all the pertinent info (annual fee, rewards, FTF, etc.), I can provide you with edit access. Just shoot me a PM to kebosabi with your gmail address and I'll provide you edit access.

Thanks for helping out!

As of October 2014, no USA-based card issuer offers Chip-and-PIN priority cards except for BMO Harris (Diners Club) and UN Federal Credit Union. Other major USA-based banks such as BofA, Chase, Citi, as well as others issue Chip-and-Signature cards which may work at many automated kiosks. However, bear in mind the word may is used above is a context where there is no absolute certainty of success for certain environments such as automated kiosks due to different natures of offline and online transactions. It is highly recommended to read Post #3 which lists real life FTer examples on how Chip-and-Signature worked and did not work at various transaction environments.

Can I upgrade it right now?

If it's listed on that Google Docs spreadsheet or SFOAMS' Silk page, wouldn't hurt to call/twitter them for a free upgrade. If you get the response you don't like, hang up, try again.

What is the difference between Chip-and-Signature and Chip-and-PIN?

You insert the chipped card into the slot. The physical contact terminal will read the EMV chip and the terminal will automatically read the preferred cardholder verification methods (called CVM) for that card.

Chip-and-Signature means that the terminal will printout a receipt for you to sign. This is the most prevalent authentication for most US issued EMV cards. Chip-and-Signature helps in a way that it will get through to face-to-face merchant transactions where you and the merchant do not speak the same language.

Chip-and-PIN means that the terminal will prompt you to input a PIN for authentication. Some credit union issued credit cards will have this CVM as secondary if Chip-and-Signature cannot be done. Chip-and-PIN is the more prevalent method of authentication used outside the US, especially in transaction environments where no human interaction is needed (i.e. automated gas pumps, toll roads, train kiosks, etc.).

The Google Docs spreadsheet will list which CVM are used in the EMV cards listed. Some cards can only do Chip-and-Signature. Other cards can do both Chip-and-Signature and Chip-and-PIN. And others might have a third option called No CVM (no authentication needed) which is reserved for low value transactions.

One chip can hold a lot more data, therefore it is capable of doing multiple verification methods. That's one of the great things about EMV over the mag-stripe which can hold very little data.

I want to know for sure what my EMV chip does. Is there anyway I can test out my own EMV card to see what the CVM list is?

alexmt has written up a nice step-by-step procedure on Post #3615.

If most of the EMV cards in the US is the Chip-and-Signature type, doesn't that mean it's still useless abroad?

Depends if you see it as glass half empty or glass half full. See Post #3 for further details on how Chip-and-Signature has worked both successfully and unsuccessfully depending on the merchant transaction environment and use your best judgment whether which one is right for you.

Are there any places in the US that are accepting transactions via the EMV chip?

tmiw has created a dedicated Google maps webpage to show where EMV has been proven to work here: http://emvacceptedhere.com/ Per his Post #4240, feel free to add any places with active EMV terminals if you come across one.

As of 2014/05, the EMV terminals in most Walmarts and Sam's Clubs are being turned on. Hence, the best place to try them out would be your local Walmart or Sam's Club. For other merchants, it's slowly being phased in.

I hope people will post them in the Post your receipt of your 1st EMV based transaction in the US thread. cvarming has shown us an EMV transaction receipt from Brooklyn, NY in Post #2380. I myself had my first EMV based (Chip-and-Signature) transaction in two stores in the Los Angeles area, as shown in detail in Post #2705 (courtesy of WhatWhatTech for pointing these two stores out)

I don't want a chip in my card. I heard horror stories all over the media saying hackers can steal my credit card info from a mile away.

There are two types of chips. One is contactless and the other is contact. Cards can be either one or the other, or both.

In the Google Docs spreadsheet, the cards that are capable of contactless payments are listed seperately under the "RFID or NFC contactless chip" column. If it says yes, then that means it has the ability to do contactless payments. If it says no, it doesn't have that feature.

The one that the media has overhyped about hackers "stealing your information wirelessly" was the contactless type like this:

You are worried about this happening, right?

You don't have to worry. EMV is a chip standard that can have both contact and contactless interfaces. With the traditional contact interface, this means you actually have to physically insert the chip into a POS terminal for it to be authorized, like this:

With the contact interface, nothing is wireless. No data is sent out in a stand-alone contact type EMV chip. With the EMV contactless interface, data is sent wirelessly.

Furthermore, contactless chip cards are required to show a symbol (looks like Wi-Fi symbol) somewhere on the card that to denote it's capability as a contactless card. For example, here's an example of a Discover Card with contactless capability (in which Discover calls "Discover ZIP") showing the contactless symbol on the back of the card:

Don't believe everything that the media says. Besides, millions of people all over the world from London to Singapore, uses contactless payments daily in extremely crowded subways and mass transit with nary any problems. There are multiple layers of encrypted securities and keys that are needed to break the code.

Frankly, giving your physical card to a waiter/waitress who takes the card out of your view is much more susceptible to fraud than contactless payments.

Why should I care?

If you are an international traveler, you will want this because majority of the world has or in the process of converting to this payment format.

In fact, in 2012, even North Korea moved to the EMV format, leaving the US as one of the countries in the world that hasn't done so.

In addition, VISA, MC, AMEX, and Discover have all agreed to incentivize the USA shifting to EMV payments by 2015 by shifting liability for fraudulent transactions to merchants if they do not have EMV equipment and the cardholder has an EMV card. So if you travel internationally or would like to get one before the others, you might be interested in getting one.

BS! I had no problems using my card in [insert whereever country], [insert whatever point in time]

If you stick to the tourist path where they have lots of visitors from the US, you should have no problems using your mag-stripe only card in hotels and restaurants, at least for now. But as things can change as things go forward.

However, consider that once you start taking the off-beaten path, go to non-touristy places where they are not familiar with mag-stripes, rent a car and use toll roads, fill up gas, or try to buy train tickets you might end up into a trouble of the machine not recognizing your card because it lacks the chip. Furthermore, a lot of toll roads, gas pumps, and automated ticket machines lack any human assistance to help you when you need it the most.

But [insert credit card company] told me all merchants that display their logo must accept them! All I have to do is report them for violating their agreements, right?

There are several factors against this.

1. You can only speak English. The merchant representative, most likely a part-time clerk earning minimum wage, speaks in a different language, let's say French. If you have no French language skills, how are you going to get your point across? Are you going to whip out your cell phone at exorbitant int'l roaming charges and hope the customer service is going to translate it for you on the spot? Or maybe you might actually know French. But how about Swahili, Farsi, Balinese, or the multiple languages in mainland China?

2. Just like US, the rest of the world's businesses uses part-time minimum wage workers as cashiers to cut down on labor costs. Most of their SOP training manuals are written by MBA types to not to do anything they are not familiar with. Do not expect them to understand the intricate details of credit card mumbo jumbo. You don't expect Taco Bell employees to understand the minute details of Discover-JCB-Union Pay agreements, right? Same thing the other way around: be respectful as a guest in their country, prepare in advance in their ways, avoid being an "ugly American" stereotype.

3. You are a guest in their country. You are a minority. If 99.9% of their country's people and other tourists from around the world uses EMV, do you really think they are going to accomodate the 0.1% of American tourists who only have mag-stripes credit cards?

4. Again, you are a guest in their country. How would you, as an American standing in line, react if a Chinese tourist was clogging up the lines at a local Taco Bell because the clerk doesn't understand the Discover-Union Pay agreement and has trouble communicating between Mandarin spoken by the tourist and English spoken by the Taco Bell clerk? Same way the other way around. You do not want to clog up the lines for everyone. The less hassle, the better.

5. VISA and MC make tons of money from merchants in that country. Say SNCF French Rail. It's a billion dollar company in France. Do you think VISA is going to pull the plug of their relationship with SNCF because SNCF refuses to do mag-stripe processing at their unmanned train station kiosk? Of course not. Be realistic.

6. And lastly, if you're up against an unstaffed toll kiosk, gas pump or train ticket machine, are you going to yell curses at the machine?

But I want my credit card to be able to be used in the US too!

No worries. They have not gotten rid of the mag-stripe on the back of the card for backward compatibility reasons, just like we still have embossed numbers on our cards for backwards compatibility to using those old carbon copy imprinters.

[insert own Hyatt card image front and back together with red arrows pointing to all the backward compatibility features]

You use the chip on the front of the card abroad (for now), and the mag-stripe just like any other card for the US. Basically, you're increasing your credit card's acceptance rate by getting a card that both via the chip and the mag-stripe. You're getting a better deal for free.

And when 2015 comes along and US switches to EMV, you'll be way ahead of everyone else too!

So why did the rest of the world and the US moved/moving toward EMV?

Primarily, due to fraud concerns. You see, the mag-stripe has been with us since the 1950s. It may have been the most high tech thing back in the day, but with the technology that is available today, any shmo can pick up a $100 USB magnetic card skimming device off of eBay and get your credit card info.

And unlike skimming off contactless cards which actually need the person to have l33t programming skills, skimming off a magnetic stripe has become so ubiquitous that nary a day goes about skimming fraud going on somewhere in America, from gas pumps, Michael's stores (2011), Target breaches (2013), restaurant waiters/waitresses, to even McDonald's drive thrus.

https://www.google.com/search?q=skimming+fraud

These type of fraud used to be prevalent in Europe. But once they started switching over to EMV starting over 2 decades ago, this type of fraud went elsewhere. It went over to Asia, Canada and Mexico, Latin America, etc. etc. until they too began implementing EMV to combat skimming fraud. The US is practically the only country left that hasn't done so, therefore all the fraud that used to take place elsewhere is now happening here.

But EMV is old and it's not fool proof. Shouldn't we just skip over it and do something new instead?

Yes, EMV is old. It was developed in the 1990s and its smart card payment predecessor was first introduced in France. But as of today, it has become the defacto global standard of payments.

But then, what else is there? There is no other de facto global standard of payments alternative. For example, if we decide to skip over it and do something new, hypothetically like DNA matching technology, it still means US int'l travelers will continue to have problems abroad with useless plastic acceptance because no other country is using this DNA matching technology except the US.

Besides, nothing is fool proof. You can say that the bank vault isn't fool proof because you can crack it open if enough C4 is used. But your average low-life scumbag isn't likely to get military grade C4 easily either. But the bank vault does make it harder to get the bank's money over say a petty cash box. That's the point here. EMV is akin to a security tight bank vault, the old mag-stripe is akin to a petty cash box lying around inside the drawer.

I'm a business owner and I don't think EMV is going to take off. I'm not going to spend extra hundreds of dollars to upgrade my credit card machine. Convince me other wise why I should.

I can understand the added extra cost to your business once this switchover takes place. But before even saying that, look at your existing POS terminal. Does it have a slot somewhere to insert a card?

Most likely, if you had replaced your POS terminal within the past five years, you already have an EMV capable terminal. EMV is basically just not turned on yet from the processor and acquirer side.

If you have an EMV capable terminal, then a best bet would be to contact your acquirer to have the EMV feature turned on. You did your end of the deal already by having an EMV capable terminal, it is now the acquirers' responsibility to turn it on in accordance to the EMV switchover mandate.

And if you don't, you are going to replace your POS terminal anyway from common wear and tear. It isn't a hard switch-over. You can continue to use your POS terminal until it dies out because EMV cardholders will still have the mag-stripe on the back. And by the time your non-EMV capable POS terminal is up for replacement the market will be full with these newer POS terminals that can accept the mag-stripe, EMV, as well as contactless payments.

In addition, you may also want to check with your acquirer or processor about EMV capable terminals. Some of them are willing to replace your terminal for free in preparation for the US EMV switchover. Call and ask for details.

But what's in it for me? I'm the one that has to pay for the upgrade.

All the major card networks have given incentives for merchants for the upcoming EMV switchover.

If 75% or more of your credit card transactions are done on an EMV contact and contactless terminal, they are going to waive your annual PCI-DSS fees, which usually costs you around $5.00-$19.95/month per terminal. The overall long term cost savings of those compliance fees will be larger than the cost of an one time upgrade for the terminal.

The downside is that once EMV switchover happens and if you do not have a POS terminal that is able to accept EMV, the fraud liability shifts over to the merchant.

I own several fast food franchises. If I upgrade my POS terminals at all of my restaurants, it's going to cost me thousands, if not millions. I don't think anyone is going to use a fake credit card to buy $5 burgers. And if they do, wouldn't it be cheaper for me to eat the fraud cost?

Remember also that fraud isn't just committed by dishonest customers using fraudulent cards. Fraud can also happen with dishonest employees skimming off credit card data from the mag-stripe as in the case of a teenage McDonald's drive thru employee skimming off $13,000 of customers' credit cards in Olympia, WA. Consider the public relations fall out that your business may have if this happens (i.e. the big Target breach of 2013, where someone used a mag stripe card to load malware INTO Target's system). Is it worth risking to take such a huge PR disaster?

USA EMV cards: Availability, Q&A (Chip & PIN -or- Chip & Signature) [2012-2015]

#6856

Join Date: Jul 2008

Location: SF Bay Area

Programs: UA Gold

Posts: 11

I note some material of interest here:

http://www.smartcardalliance.org/publications-emv-faq/

(especially the bullets about verification and authorization)

and here:

http://www.mastercard.us/cardholder_verification.html

My reading of this material is that "Chip and PIN (offline)" refers to a card that supports the offline PIN verification method. This says nothing about whether such a PIN verification can provide authentication evidence for an online authorization (since authentication and authorization are distinct operations.) This would seem important since most Chip-and-PIN transactions are online-authorized.

Hopefully then, "Chip and PIN (offline)" in the spreadsheet at the top of this thread means the same as "Chip and PIN".

True?

http://www.smartcardalliance.org/publications-emv-faq/

(especially the bullets about verification and authorization)

and here:

http://www.mastercard.us/cardholder_verification.html

My reading of this material is that "Chip and PIN (offline)" refers to a card that supports the offline PIN verification method. This says nothing about whether such a PIN verification can provide authentication evidence for an online authorization (since authentication and authorization are distinct operations.) This would seem important since most Chip-and-PIN transactions are online-authorized.

Hopefully then, "Chip and PIN (offline)" in the spreadsheet at the top of this thread means the same as "Chip and PIN".

True?

#6857

Join Date: Jul 2006

Location: SAN

Posts: 1,171

Yes CardPeek was updated to read the US Amex CVM list. I think it was last month. Just go to the CardPeek site and download and install the new version.

#6858

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,500

Exactly, interesting... two Discover cards there.

P.S. Walmart's claim of WHY they're only at 97% is because some stores have brackets that block the chip slot, so they couldn't be turned on. What makes no sense is that Kalispell, MT does NOT have anything blocking the chip slots?

P.S. Walmart's claim of WHY they're only at 97% is because some stores have brackets that block the chip slot, so they couldn't be turned on. What makes no sense is that Kalispell, MT does NOT have anything blocking the chip slots?

I note some material of interest here:

http://www.smartcardalliance.org/publications-emv-faq/

(especially the bullets about verification and authorization)

and here:

http://www.mastercard.us/cardholder_verification.html

My reading of this material is that "Chip and PIN (offline)" refers to a card that supports the offline PIN verification method. This says nothing about whether such a PIN verification can provide authentication evidence for an online authorization (since authentication and authorization are distinct operations.) This would seem important since most Chip-and-PIN transactions are online-authorized.

Hopefully then, "Chip and PIN (offline)" in the spreadsheet at the top of this thread means the same as "Chip and PIN".

True?

http://www.smartcardalliance.org/publications-emv-faq/

(especially the bullets about verification and authorization)

and here:

http://www.mastercard.us/cardholder_verification.html

My reading of this material is that "Chip and PIN (offline)" refers to a card that supports the offline PIN verification method. This says nothing about whether such a PIN verification can provide authentication evidence for an online authorization (since authentication and authorization are distinct operations.) This would seem important since most Chip-and-PIN transactions are online-authorized.

Hopefully then, "Chip and PIN (offline)" in the spreadsheet at the top of this thread means the same as "Chip and PIN".

True?

#6859

FlyerTalk Evangelist

Join Date: Dec 2009

Location: HaMerkaz/Exit 145

Programs: UA, LY, BA, AA

Posts: 13,167

Transactions can be authorized either offline (without a connection to the issuer) or online. Likewise, authentication of the cardholder can be done offline or online. It's completely possible to have the card itself check the PIN yet have the transaction authorize online. However, anything other than offline PIN requires a connection to the issuer for authorization.

Why do this? I thought online PIN is considered "safer" or "more secure." If so, and if they clearly have the ability to contact the issuer, (I presume PIN authentication and transaction authorization go to the same place when checked online,) why do offline PIN?

#6860

Join Date: Jul 2010

Location: New York

Programs: Cutting down :-(

Posts: 604

I know places like Canada authorize the transaction online but authenticate offline.

Why do this? I thought online PIN is considered "safer" or "more secure." If so, and if they clearly have the ability to contact the issuer, (I presume PIN authentication and transaction authorization go to the same place when checked online,) why do offline PIN?

Why do this? I thought online PIN is considered "safer" or "more secure." If so, and if they clearly have the ability to contact the issuer, (I presume PIN authentication and transaction authorization go to the same place when checked online,) why do offline PIN?

Last edited by cvarming; Sep 17, 2014 at 6:34 am

#6862

Suspended

Join Date: Oct 2004

Location: Bay Area

Programs: DL SM, UA MP.

Posts: 12,729

Well I got to do my first PIN transaction with my Barclays Arrival Plus card at a gas station in France for just under 26€.

However when I topped off a couple of days later at another station, I had to sign for a 10€ purchase. This gas station didn't take credit cards at all the pumps so I had to go to the cashier.

The key pad is showing signature on most other purchases though. But I'm not having to sign or use the PIN on smaller transactions.

My Chase Sapphire Preferred worked at an automatic metro ticket machine. Hope Chase goes PIN soon.

However when I topped off a couple of days later at another station, I had to sign for a 10€ purchase. This gas station didn't take credit cards at all the pumps so I had to go to the cashier.

The key pad is showing signature on most other purchases though. But I'm not having to sign or use the PIN on smaller transactions.

My Chase Sapphire Preferred worked at an automatic metro ticket machine. Hope Chase goes PIN soon.

#6863

Join Date: Apr 2013

Posts: 57

Once again, even the best technology works only as well as the human who's using it.

A Briton visiting Prague had his wallet pickpocketed, but he and his wife figured their chip-and-PIN cards would protect them. Unfortunately, the bad guys had spotted the PIN when the couple used a cash machine. And all of their cards were set to the same PIN.

http://www.whatprice.co.uk/financial...it-abroad.html

A Briton visiting Prague had his wallet pickpocketed, but he and his wife figured their chip-and-PIN cards would protect them. Unfortunately, the bad guys had spotted the PIN when the couple used a cash machine. And all of their cards were set to the same PIN.

http://www.whatprice.co.uk/financial...it-abroad.html

#6864

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,044

Once again, even the best technology works only as well as the human who's using it.

A Briton visiting Prague had his wallet pickpocketed, but he and his wife figured their chip-and-PIN cards would protect them. Unfortunately, the bad guys had spotted the PIN when the couple used a cash machine. And all of their cards were set to the same PIN.

http://www.whatprice.co.uk/financial...it-abroad.html

A Briton visiting Prague had his wallet pickpocketed, but he and his wife figured their chip-and-PIN cards would protect them. Unfortunately, the bad guys had spotted the PIN when the couple used a cash machine. And all of their cards were set to the same PIN.

http://www.whatprice.co.uk/financial...it-abroad.html

#6865

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,500

You know, being chip and signature for contact EMV might turn out to be a benefit over the long term, and not just because of the DCC protection. If Apple Pay and Google Wallet do get much traction, they'll effectively provide the PIN or biometric security that we've been wanting from our cards in the first place. And in order for them to get much traction, a) we need to move to EMV and b) a company like Apple needs to make contactless easy to use. Plus, Apple Pay will eventually work overseas too so there won't be compatibility issues as long as merchants support NFC.

Besides, if Visa required PIN, banks would balk and EMV would most likely never happen without government intervention. PIN can always happen later if Apple Pay flops. It's not like anyone's actually going to produce signature-only terminals in large numbers anyway due to MC's liability shift.

Besides, if Visa required PIN, banks would balk and EMV would most likely never happen without government intervention. PIN can always happen later if Apple Pay flops. It's not like anyone's actually going to produce signature-only terminals in large numbers anyway due to MC's liability shift.

#6866

Join Date: Nov 2012

Posts: 3,537

Besides, if Visa required PIN, banks would balk and EMV would most likely never happen without government intervention. PIN can always happen later if Apple Pay flops. It's not like anyone's actually going to produce signature-only terminals in large numbers anyway due to MC's liability shift.

#6867

FlyerTalk Evangelist

Join Date: Dec 2009

Location: HaMerkaz/Exit 145

Programs: UA, LY, BA, AA

Posts: 13,167

Even though it's anyways going online to authorize the transaction?

How does it provide protection for DCC, anymore than C&P? You should be able to anyways choose - unless you mean you can sign the slip and specifically cross out the other currency?

Right, and combine that with the large number of credit cards that won't have PIN. Though from what I understand from MC, any card that doesn't have PIN as CVM1 would be "penalized" in the event of lost/stolen, as long as it's used in a terminal with a PIN pad (though that doesn't seem that much different than today).

Only way to push Square would be for people to "lose" lots of UNFCU cards, and have them used at Square. After enough fraud, Square would pack up or change. (Not seriously suggesting that!)

Only way to push Square would be for people to "lose" lots of UNFCU cards, and have them used at Square. After enough fraud, Square would pack up or change. (Not seriously suggesting that!)

#6868

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,500

However, signature only terminals might be more prevalent in the restaurant industry. A lot of places probably don't want to shell out the money for wireless terminals that servers take to patrons and don't want to make people have to pay at the front.

Right, and combine that with the large number of credit cards that won't have PIN. Though from what I understand from MC, any card that doesn't have PIN as CVM1 would be "penalized" in the event of lost/stolen, as long as it's used in a terminal with a PIN pad (though that doesn't seem that much different than today).

Only way to push Square would be for people to "lose" lots of UNFCU cards, and have them used at Square. After enough fraud, Square would pack up or change. (Not seriously suggesting that!)

Only way to push Square would be for people to "lose" lots of UNFCU cards, and have them used at Square. After enough fraud, Square would pack up or change. (Not seriously suggesting that!)

So anyway, has anyone actually seen a signature-only terminal?

#6869

Join Date: Jul 2014

Location: United Kingdom

Posts: 93

Once again, even the best technology works only as well as the human who's using it.

A Briton visiting Prague had his wallet pickpocketed, but he and his wife figured their chip-and-PIN cards would protect them. Unfortunately, the bad guys had spotted the PIN when the couple used a cash machine. And all of their cards were set to the same PIN.

http://www.whatprice.co.uk/financial...it-abroad.html

A Briton visiting Prague had his wallet pickpocketed, but he and his wife figured their chip-and-PIN cards would protect them. Unfortunately, the bad guys had spotted the PIN when the couple used a cash machine. And all of their cards were set to the same PIN.

http://www.whatprice.co.uk/financial...it-abroad.html

Mr. and Mrs. B?

The "article" (which reads like linkbait garbage to me) doesn't even mention that Mr. and Mrs B have been grossly negligent and under UK law would be liable for all of the losses as they did not report the cards as stolen.

Because they were either complete morons or they didn't exist.

#6870

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,500

First National Bank is offering EMV cards now. Interestingly enough, they also offer the only third party Discover card that I've ever seen (not EMV enabled, however).

(BTW, they're also chip and signature)

(BTW, they're also chip and signature)