Liability insurance on Rental Car in California

#76

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,599

So, to clarify:

If all of the following are true:

1) You don't have any sort of auto insurance (since you don't own a car)

2) You live in CA

3) You rent a car in CA

Then you'd be a fool to decline the Liability insurance offered to you at the rental counter for ~$13/day -- even if you have CDW coverage through Credit Cards (Chase Sapphire Preferred, in this case).

Is that correct?

If all of the following are true:

1) You don't have any sort of auto insurance (since you don't own a car)

2) You live in CA

3) You rent a car in CA

Then you'd be a fool to decline the Liability insurance offered to you at the rental counter for ~$13/day -- even if you have CDW coverage through Credit Cards (Chase Sapphire Preferred, in this case).

Is that correct?

#77

FlyerTalk Evangelist

Join Date: Mar 2004

Location: SGF

Programs: AS, AA, UA, AGR S (former 75K, GLD, 1K, and S+, now an elite peon)

Posts: 23,194

In California, rental car companies, as any car owner, are required to have basic liability protection and provide it with their base rates. However, that coverage, 15/30/5, is grossly inadequate nowadays and chances are that in case of a loss the rental company will go after the renter to recover any payout.

In most other states (a few exceptions where it's actually primary), the car company's insurance is secondary to your own...meaning if you don't carry any, theirs steps in (and is, in effect, primary).

In California, that is NOT the case. You have ZERO coverage for liability. Whether you put a $300 ding in someone else's fender or crash into a Rolls-Royce and put a $1,000-an-hour attorney out of work for a year, you are completely, 100% on the hook for damages to a third party.

Now, the third party's legal team may be able to extract some money from the rental company's insurance carrier one way or another, but no matter what, you're going to have hell to pay if you don't have liability coverage with adequate limits.

Last edited by jackal; Sep 1, 2014 at 11:52 pm

#78

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,599

From Hertz Rental Qualifications and Requirements:

#79

FlyerTalk Evangelist

Join Date: Dec 2003

Location: Not here; there!

Programs: AA Lifetime Gold

Posts: 29,531

Wirelessly posted (BlackBerry: BlackBerry8530/5.0.0.1030 Profile/MIDP-2.1 Configuration/CLDC-1.1 VendorID/417)

Point 1 is based on the incorrect assumption that one who does not own a car does not have auto insurance. Depending on how many days a year you rent a car, it might be worthwhile to investigate the cost of a non-owned automobile liability policy. (Mine is issued by Travelers Insurance.)

Originally Posted by idlingbye

So, to clarify:

If all of the following are true:

1) You don't have any sort of auto insurance (since you don't own a car)

2) You live in CA

3) You rent a car in CA

Then you'd be a fool to decline the Liability insurance offered to you at the rental counter for ~$13/day -- even if you have CDW coverage through Credit Cards (Chase Sapphire Preferred, in this case).

Is that correct?

If all of the following are true:

1) You don't have any sort of auto insurance (since you don't own a car)

2) You live in CA

3) You rent a car in CA

Then you'd be a fool to decline the Liability insurance offered to you at the rental counter for ~$13/day -- even if you have CDW coverage through Credit Cards (Chase Sapphire Preferred, in this case).

Is that correct?

#81

Join Date: Nov 2009

Location: PHX

Programs: UA *Alliance

Posts: 5,591

#82

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,599

Such products are offered by GEICO, Progressive and others.

#83

Join Date: Aug 2017

Posts: 1,610

I am bumping this old thread to ask if anything has changed, specifically regarding liability coverage provided in California? Hertz now has two pages:

1. https://www.hertz.com/rentacar/reser...RAGES&EOAG=SFO (this one says in California you are not covered for state minimum liability)

2. https://www.hertz.com/rentacar/produ...ctedAreYou.jsp (this page makes no such mention of California being excluded from you getting state minimum liability)

So now ... what's the deal? Does anyone have a recent hertz rental car packet from California to verify?

Edit: Answering my own question - hertz sneakily has removed the mention of California from the second page, but has added something about "where required by law". By looking online, state-by-state, this means you are automatically covered in every state for minimum liability except California AND Texas.

I did have a situation recently though where I rented in Oregon (automatic liability included per state law), but then drove the car to California for a day, before returning the car back in Oregon. In that case it really isn't clear if I had coverage during my day in California? I think so, since Oregon laws should apply as that's where the rental contract was executed, but who knows.

1. https://www.hertz.com/rentacar/reser...RAGES&EOAG=SFO (this one says in California you are not covered for state minimum liability)

2. https://www.hertz.com/rentacar/produ...ctedAreYou.jsp (this page makes no such mention of California being excluded from you getting state minimum liability)

So now ... what's the deal? Does anyone have a recent hertz rental car packet from California to verify?

Edit: Answering my own question - hertz sneakily has removed the mention of California from the second page, but has added something about "where required by law". By looking online, state-by-state, this means you are automatically covered in every state for minimum liability except California AND Texas.

I did have a situation recently though where I rented in Oregon (automatic liability included per state law), but then drove the car to California for a day, before returning the car back in Oregon. In that case it really isn't clear if I had coverage during my day in California? I think so, since Oregon laws should apply as that's where the rental contract was executed, but who knows.

Last edited by nomiiiii; May 11, 2018 at 1:29 pm

#84

Company Representative - AutoSlash and HotelSlash

Join Date: Jun 2006

Location: autoslash.com | hotelslash.com

Posts: 5,657

Edit: Answering my own question - hertz sneakily has removed the mention of California from the second page, but has added something about "where required by law". By looking online, state-by-state, this means you are automatically covered in every state for minimum liability except California AND Texas.

Where permitted by law, no liability protection is provided under the terms of the Rental Agreement from claims of injury by others against you resulting from an accident with the rental car. Some locations provide primary protection under the Rental Agreement. However, in those situations where protection is provided by Hertz, such protection is generally no more than the minimum limits required by individual state law. (See chart for these Financial Responsibility Limits). For these reasons, some people feel more comfortable traveling with additional liability protection. That is why Hertz makes the Liability Insurance Supplement (LIS) option available to you.

I did have a situation recently though where I rented in Oregon (automatic liability included per state law), but then drove the car to California for a day, before returning the car back in Oregon. In that case it really isn't clear if I had coverage during my day in California? I think so, since Oregon laws should apply as that's where the rental contract was executed, but who knows.

#85

Join Date: Feb 2011

Posts: 1,353

I am bumping this old thread to ask if anything has changed, specifically regarding liability coverage provided in California? Hertz now has two pages:

1. https://www.hertz.com/rentacar/reservation/reviewmodifycancel/templates/rentalTerms.jsp?KEYWORD=COVERAGES&EOAG=SFO (this one says in California you are not covered for state minimum liability)

2. https://www.hertz.com/rentacar/produ...ctedAreYou.jsp (this page makes no such mention of California being excluded from you getting state minimum liability)

So now ... what's the deal? Does anyone have a recent hertz rental car packet from California to verify?

Edit: Answering my own question - hertz sneakily has removed the mention of California from the second page, but has added something about "where required by law". By looking online, state-by-state, this means you are automatically covered in every state for minimum liability except California AND Texas.

I did have a situation recently though where I rented in Oregon (automatic liability included per state law), but then drove the car to California for a day, before returning the car back in Oregon. In that case it really isn't clear if I had coverage during my day in California? I think so, since Oregon laws should apply as that's where the rental contract was executed, but who knows.

1. https://www.hertz.com/rentacar/reservation/reviewmodifycancel/templates/rentalTerms.jsp?KEYWORD=COVERAGES&EOAG=SFO (this one says in California you are not covered for state minimum liability)

2. https://www.hertz.com/rentacar/produ...ctedAreYou.jsp (this page makes no such mention of California being excluded from you getting state minimum liability)

So now ... what's the deal? Does anyone have a recent hertz rental car packet from California to verify?

Edit: Answering my own question - hertz sneakily has removed the mention of California from the second page, but has added something about "where required by law". By looking online, state-by-state, this means you are automatically covered in every state for minimum liability except California AND Texas.

I did have a situation recently though where I rented in Oregon (automatic liability included per state law), but then drove the car to California for a day, before returning the car back in Oregon. In that case it really isn't clear if I had coverage during my day in California? I think so, since Oregon laws should apply as that's where the rental contract was executed, but who knows.

"If renting in any other state in the U.S.A.: Hertz' liability protection is secondary to any other insurance coverage available to you. If you do not have liability insurance and/or the limits of liability of the insurance coverage available to you are not sufficient to cover claims by others against you, and Hertz, as the vehicle owner, provides liability protection due to an accident, you will indemnify Hertz for any and all payments made."

So even if Hertz pays a third party, they can turn around and collect that amount directly from you whether you have insurance or not. And nothing prevents the third party from suing you directly for anything above the state minimum. Even in the 7 states with primary coverage, you can be sued for damages above the state minimum -- and an injury that sends someone to the hospital for surgery can easily end up costing you several hundred thousand dollars.

I think the nuance in CA and TX is that Hertz attempts to disclaim their responsibility as car owner to the third party, which may or may not be successful if you and Hertz are both sued. Otherwise, from my reading there's no real "coverage" in any but those few states. And the second link shows that Hertz is trying to be vague about which states even have that coverage.

I simply wouldn't risk driving a car with anything close to the state minimums, much less no coverage at all. The risk to the renter's finances is just too big, as well as the risk of leaving a legitimately injured victim with crushing bills of their own once the renter's assets are drained.

So even if Hertz pays a third party, they can turn around and collect that amount directly from you whether you have insurance or not. And nothing prevents the third party from suing you directly for anything above the state minimum. Even in the 7 states with primary coverage, you can be sued for damages above the state minimum -- and an injury that sends someone to the hospital for surgery can easily end up costing you several hundred thousand dollars.

I think the nuance in CA and TX is that Hertz attempts to disclaim their responsibility as car owner to the third party, which may or may not be successful if you and Hertz are both sued. Otherwise, from my reading there's no real "coverage" in any but those few states. And the second link shows that Hertz is trying to be vague about which states even have that coverage.

I simply wouldn't risk driving a car with anything close to the state minimums, much less no coverage at all. The risk to the renter's finances is just too big, as well as the risk of leaving a legitimately injured victim with crushing bills of their own once the renter's assets are drained.

#86

Join Date: Sep 2018

Posts: 1

I had to deal with this problem just a few days ago with Sixt. I do not own a car, and use my credit card as primary for collision/damage. In my experience, the agents at the discount agencies will pull shenanigans to earn commission. I've never had this problem with the more well known agencies like Enterprise or Hertz.

At Sixt, my pickup conversation went something like this:

Agent: Do you have proof of insurance coverage?

Me: No, my card is my primary.

Agent: That does not cover liability. Do you have proof of liability insurance?

Me: I do not want liability coverage.

Agent: California requires liability insurance.

Me: I've never had to buy it before.

Agent: You need liability coverage to drive in California.

Me; OK, fine, just add it. (At this point I was tired and annoyed, did not feel like dealing with her anymore, and planning on inspecting the contract and terms after the fact to dispute her claim).

I finally was able to get my car. After spending about 5 minutes doing a quick internet search and reading of the contract terms, I found the clause where Sixt will provide minimum liability if you do not have any. I was pretty upset at the deception, and then went back to show her the terms and get my money back. She gave me a lot of attitude, claiming that I never said no, that she never lied about anything, and that I cut her off and didn't let her finish. The only positive is that she did not put up any resistance to removing the SLI policy.

So, if you really don't want to buy the additional SLI, don't be strong-armed into it. They will say and do things that are not specifically untrue, but intended to give you the impression that you must buy the insurance. Every question/statement was designed to lead me into buying additional coverage, regardless of whether or not I had my own policies.

Be very clear that you do not want the coverage, ask to see the contract, and if they insist on playing a cat-and-mouse game, force them to say that they cannot or will not rent the car to you without coverage. Straight out lying is a line they proabably don't want to cross.

At Sixt, my pickup conversation went something like this:

Agent: Do you have proof of insurance coverage?

Me: No, my card is my primary.

Agent: That does not cover liability. Do you have proof of liability insurance?

Me: I do not want liability coverage.

Agent: California requires liability insurance.

Me: I've never had to buy it before.

Agent: You need liability coverage to drive in California.

Me; OK, fine, just add it. (At this point I was tired and annoyed, did not feel like dealing with her anymore, and planning on inspecting the contract and terms after the fact to dispute her claim).

I finally was able to get my car. After spending about 5 minutes doing a quick internet search and reading of the contract terms, I found the clause where Sixt will provide minimum liability if you do not have any. I was pretty upset at the deception, and then went back to show her the terms and get my money back. She gave me a lot of attitude, claiming that I never said no, that she never lied about anything, and that I cut her off and didn't let her finish. The only positive is that she did not put up any resistance to removing the SLI policy.

So, if you really don't want to buy the additional SLI, don't be strong-armed into it. They will say and do things that are not specifically untrue, but intended to give you the impression that you must buy the insurance. Every question/statement was designed to lead me into buying additional coverage, regardless of whether or not I had my own policies.

Be very clear that you do not want the coverage, ask to see the contract, and if they insist on playing a cat-and-mouse game, force them to say that they cannot or will not rent the car to you without coverage. Straight out lying is a line they proabably don't want to cross.

#87

Join Date: Dec 2019

Posts: 2

I trust that you are aware of California's special requirements re: third-party liability insurance when renting cars within the state. If you have a personal auto insurance policy that covers you when driving a rental car and you plan to rely on that policy's coverage on this rental, I recommend that you bring along a copy of your policy's declarations page on this trip, in case you are stopped by the police and asked to provide proof of liability insurance.

#88

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,599

If you own a car and have insurance, you are probably covered by your personal policy when renting a car. Some insurance companies offer liability coverage to individuals who don’t own cars. Car rental agencies also sell supplemental liability insurance at a cost that generally ranges between $10 and $20 a day.

P.S. I relocated your question to the relevant forum and thread.

#90

Moderator: Travel Safety/Security, Travel Tools, California, Los Angeles; FlyerTalk Evangelist

Join Date: Dec 2009

Location: LAX

Programs: oneword Emerald

Posts: 20,599

I can't recall the last time that I was asked to provide proof of insurance when renting a car from a major car rental agency in the US; well, except when I get a loaner from the dealer when I take my car in for service.

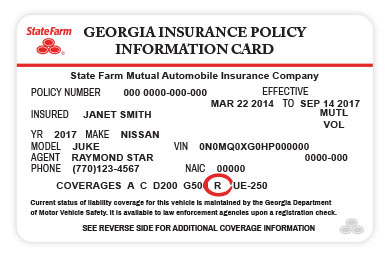

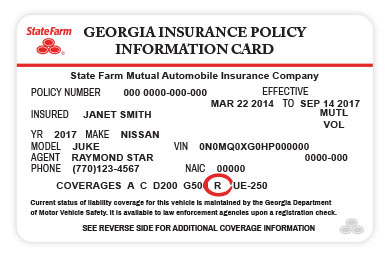

Most insurers issue proof of insurance ID cards to be carried in the vehicle, which contain the policy information, that should suffice. Here is an example of what it may look like:

Most insurers issue proof of insurance ID cards to be carried in the vehicle, which contain the policy information, that should suffice. Here is an example of what it may look like: