Last edit by: yyznomad

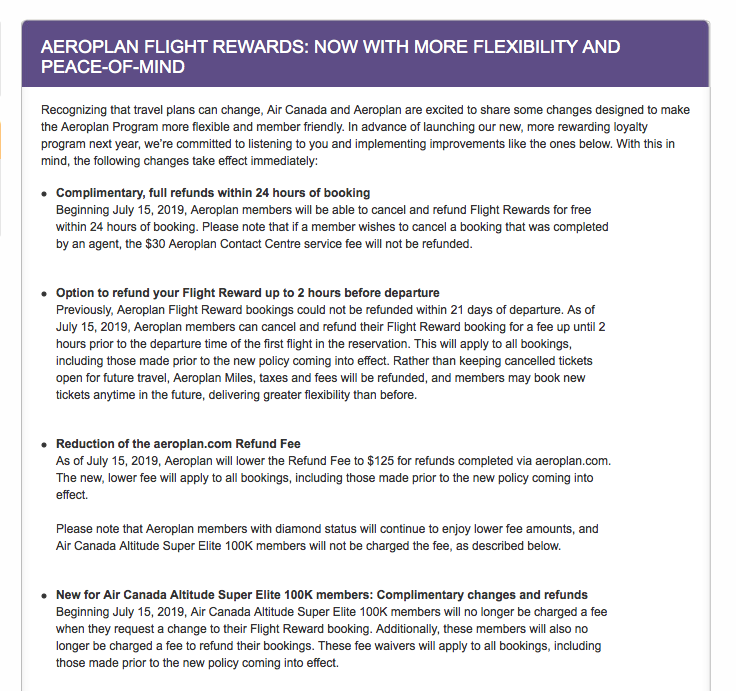

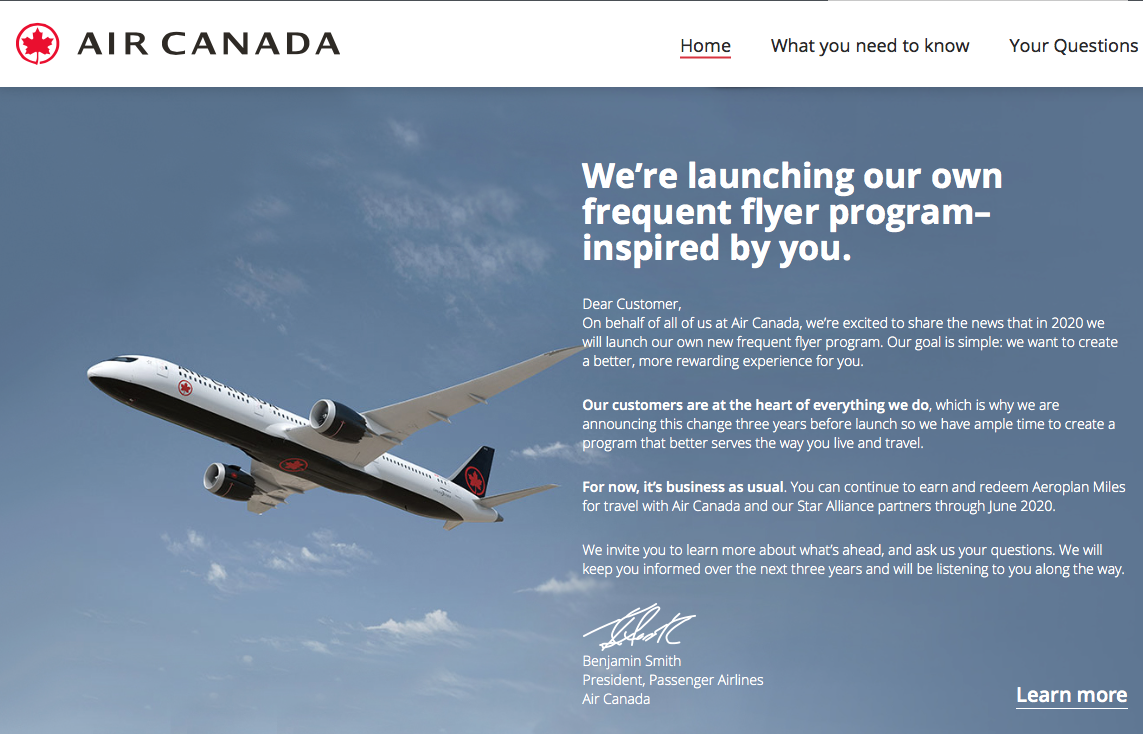

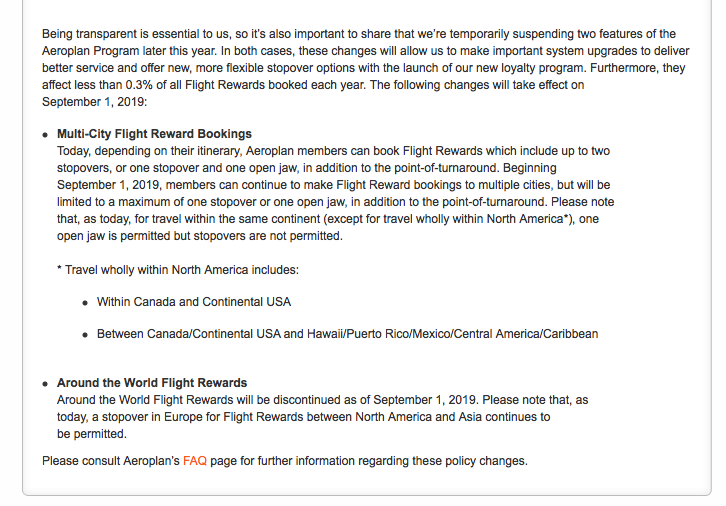

Such that it is actually searchable text - one of the important changes to the Aeroplan program in 2019 for Super Elites:

New for Air Canada Altitude Super Elite 100K members: Complimentary changes and refunds

Beginning July 15, 2019, Air Canada Super Elite 100K members will no longer be charged a fee when they request a change to their Flight Reward booking. Additionally, these members will also no longer be charged a fee to refund their bookings. These fee waivers will apply to all bookings, including those made prior to the new policy coming into effect.

Read the below screenshots for the rest.

July 15 2019

"AEROPLAN FLIGHT REWARDS: NOW WITH MORE FLEXIBILITY AND PEACE-OF-MIND"

https://www.aeroplan.com/whats_new/news_articles.do?dl=WhatsNew_WEBUP31000285_2019_07 _15ĄtLanguage=en

New chart with fees in this post

https://www.flyertalk.com/forum/31306687-post1334.html

Older news releases from 2017 below

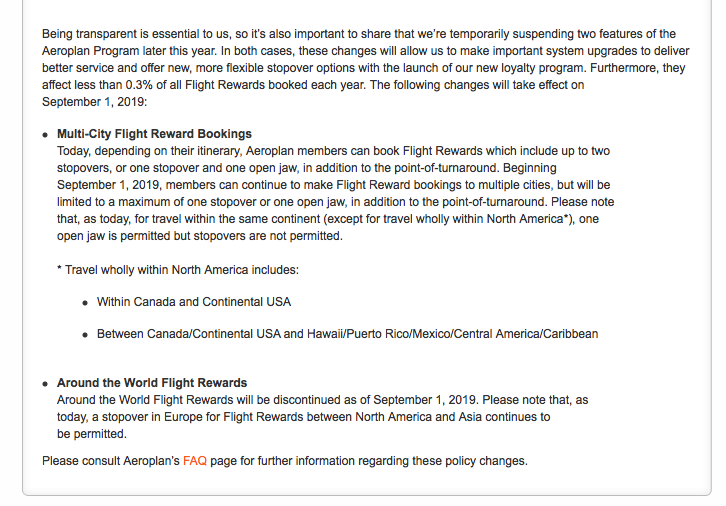

Air Canada "What You Need to Know"

https://www.aircanada.com/ca/en/aco/...d-to-know.html

Air Canada Press Release May 11, 2017

http://aircanada.mediaroom.com/index.php?s=43&item=1135

Aeroplan News "To Our Valued Members" - May 11, 2017

https://www5.aeroplan.com/whats_new/...New_2017_05_09

Aeroplan & Air Canada update

We'd like to help our members understand the latest news about our partner, Air Canada.

https://www5.aeroplan.com/aircanada-...id=BAN30000311

From Aeroplan - UPDATE May 31, 2017

https://www5.aeroplan.com/aircanada-and-aeroplan-update.do

Aeroplan Saga Ends in a Long, Financial Detour:

https://www.theglobeandmail.com/repo...ticle35080509/

August 11 2017

"We're on solid ground so your plans can take flight."

https://www.aeroplan.com/program-updates.do?currentLanguage=en&cid=008692096

"Five things you need to know about your miles"

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

September 19, 2017 - Investor Day Presentation

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

//

New for Air Canada Altitude Super Elite 100K members: Complimentary changes and refunds

Beginning July 15, 2019, Air Canada Super Elite 100K members will no longer be charged a fee when they request a change to their Flight Reward booking. Additionally, these members will also no longer be charged a fee to refund their bookings. These fee waivers will apply to all bookings, including those made prior to the new policy coming into effect.

Read the below screenshots for the rest.

July 15 2019

"AEROPLAN FLIGHT REWARDS: NOW WITH MORE FLEXIBILITY AND PEACE-OF-MIND"

https://www.aeroplan.com/whats_new/news_articles.do?dl=WhatsNew_WEBUP31000285_2019_07 _15ĄtLanguage=en

New chart with fees in this post

https://www.flyertalk.com/forum/31306687-post1334.html

Older news releases from 2017 below

Air Canada "What You Need to Know"

https://www.aircanada.com/ca/en/aco/...d-to-know.html

Air Canada Press Release May 11, 2017

http://aircanada.mediaroom.com/index.php?s=43&item=1135

Aeroplan News "To Our Valued Members" - May 11, 2017

https://www5.aeroplan.com/whats_new/...New_2017_05_09

Aeroplan & Air Canada update

We'd like to help our members understand the latest news about our partner, Air Canada.

https://www5.aeroplan.com/aircanada-...id=BAN30000311

From Aeroplan - UPDATE May 31, 2017

https://www5.aeroplan.com/aircanada-and-aeroplan-update.do

Aeroplan Saga Ends in a Long, Financial Detour:

https://www.theglobeandmail.com/repo...ticle35080509/

August 11 2017

"We're on solid ground so your plans can take flight."

https://www.aeroplan.com/program-updates.do?currentLanguage=en&cid=008692096

"Five things you need to know about your miles"

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

September 19, 2017 - Investor Day Presentation

https://www.aeroplan.com/five-things-about-your-miles.do?currentLanguage=en

//

Air Canada to Launch Its Own Loyalty Program in 2020

#616

Join Date: Dec 2011

Location: West

Posts: 3,357

Are you saying they have this kind of money to redeem the points in buying tickets and such. AP said they have $ 700 M purchasing power per year that other lines may be interested. Do they have that much cash to work with? or do they rely on new cash coming in from sponsors for that.

#617

Join Date: Nov 1999

Location: MEX/YVR/YYF

Programs: AS MVP/AC75K/AM Gold/UA*S/SPG-Marriott Lifetime Titanium/Accor-FPC Gold/HHDiamond/Hyatt Exp

Posts: 5,035

http://www.frugaltravelguy.com/2017/...-aeroplan.html

I was left a but puzzled by this article above.

It gives a rather rosey outlook for the breakup; not what I expect at all.

I was left a but puzzled by this article above.

It gives a rather rosey outlook for the breakup; not what I expect at all.

#618

Join Date: Apr 2006

Location: YTZ

Programs: Hertz & Avis PC; National EE; SPG & Hilton Gold; AC 35K (yawn)

Posts: 5,921

http://www.frugaltravelguy.com/2017/...-aeroplan.html

I was left a but puzzled by this article above.

It gives a rather rosey outlook for the breakup; not what I expect at all.

I was left a but puzzled by this article above.

It gives a rather rosey outlook for the breakup; not what I expect at all.

#619

Join Date: Dec 2008

Location: Delta, BC

Posts: 1,646

Are you saying they have this kind of money to redeem the points in buying tickets and such. AP said they have $ 700 M purchasing power per year that other lines may be interested. Do they have that much cash to work with? or do they rely on new cash coming in from sponsors for that.

#620

Join Date: Sep 2008

Programs: A3 *G, AA exePlat, AS MVP 75k Gold, JL sapphire, UA silver

Posts: 4,035

this 700m is meqningless. any company that has access to the deeply discount award space ought to be able to generate plenty of revenue.

if you sell something at a loss, you can get plenty of revenue easily.

aeroplan can access this space because air canada is part of the alliance and.contribute it share of award space.

if you sell something at a loss, you can get plenty of revenue easily.

aeroplan can access this space because air canada is part of the alliance and.contribute it share of award space.

#621

Join Date: Apr 2007

Location: Toronto, Ont., Canada

Programs: Aeroplan; Marriott Platinum; IHG Platinum; Best Western Diamond

Posts: 2,165

What I find curiously absent in this interview is any reiteration re: dividend payout on the next ex-dividend date of 14/06. Mr. Johnston could have boosted the confidence of investors by saying "Our financials remain strong and we expect to continue to pay the previously declared dividend on schedule and for the balance of the year." This single sentence alone would have been enough to cause a sharp reversal of the stock price and he knows it too. So the fact he was mum about the dividend says to me he is not nearly as confident as he claims to be, that's how I read his interview. I think the investors will remain nervous until there is a clearer plan on how Aimia intends to replace AC. I would still urge an accelerated draw down of any Aeroplan balance without delay and shift your points earnings activities elsewhere if possible to safeguard against any sudden devaluation or unannounced shutdown.

The company is damaged and bleeding. There is pressure for them to cut the already announced dividend, so save money. But if they cut that dividend, the stock will tank.

If they don't cut the dividend, the stock will definitely drop at the ex-dividend date. So speculators might buy now, hoping for a quick dividend, but stock don't drop more than the dividend amount come June 14.

We've shifted our earning of aeropeso from our ae cards, to other cards. We're also looking for redemptions soon than later. ae need to transform to an Air Miles kind of company, but AM got a headstart in signing up lots more companies. The future just doesn't look good for ae.

#622

Join Date: Dec 2011

Location: West

Posts: 3,357

#623

I would advise against a panic at this point. It is true that Aimia stock price cannot sustain the downward volatility we are seeing lately but this may well be a case of an overreaction by the market due to absence of any other information. In this sense, the stock market is not that different to this forum. We react emotionally to lack of information by taking steps to reduce our exposure to Aeroplan, so do the investors. They take steps to reduce their own exposure to Aimia absent of information. But clearly, neither FFs nor investors will completely quit Aeroplan/Aimia just yet.

Originally Posted by Guava

The market is not saying Aimia is near bankruptcy, or that the current stock price is its liquidation value. In truth, if a publicly traded company were to go into bankruptcy, chances are the value to shareholders is going to be very close or equal to zero because creditors would get paid first, leaving next to nothing for equity holders.

Like I said earlier, absent of any credible information regarding Aimia's plan going forward, investors like you and me will have to fill the void with our imagination and guesses. At this time, there is a lot of nervous energy regarding Aimia and Aeroplan, so the market is driven by high emotions in the absence of information. It is not possible to perform any adequate fundamental analysis at this point on Aimia. Any models used to do such a job will be plagued by multiple gaps in information and the need to make quite a leap in many assumptions. And that is not even the biggest obstacle, it is not knowing what Aimia plans to do that is the irreplaceable unknown. I can certainly make a best effort estimate of consumer reactions, projected credit card sales for the next 6 months but all of that is irrelevant if we don't know what Aimia will do in 2018, 2019, 2020 and beyond.

The real problem is the poor corporate communication and lack of social media engagement. Why isn't there an Aeroplan representative on FT right now? on Facebook? on Twitter? You need a dedicated PR team to handle the public and engage and interact with them, especially now. There are rumors circulating regarding Aeroplan doing some sort of *Net filtering. But no one is able to debunk these rumors. If true, the company needs to come out and be upfront with their customers. If not true, this needs to be debunked ASAP.

I don't think Aimia is really in any immediate danger of going belly up, not from a financial standpoint anyway but the company needs to take charge of the situation or people will draw their own conclusions and imagine the worse.

Like I said earlier, absent of any credible information regarding Aimia's plan going forward, investors like you and me will have to fill the void with our imagination and guesses. At this time, there is a lot of nervous energy regarding Aimia and Aeroplan, so the market is driven by high emotions in the absence of information. It is not possible to perform any adequate fundamental analysis at this point on Aimia. Any models used to do such a job will be plagued by multiple gaps in information and the need to make quite a leap in many assumptions. And that is not even the biggest obstacle, it is not knowing what Aimia plans to do that is the irreplaceable unknown. I can certainly make a best effort estimate of consumer reactions, projected credit card sales for the next 6 months but all of that is irrelevant if we don't know what Aimia will do in 2018, 2019, 2020 and beyond.

The real problem is the poor corporate communication and lack of social media engagement. Why isn't there an Aeroplan representative on FT right now? on Facebook? on Twitter? You need a dedicated PR team to handle the public and engage and interact with them, especially now. There are rumors circulating regarding Aeroplan doing some sort of *Net filtering. But no one is able to debunk these rumors. If true, the company needs to come out and be upfront with their customers. If not true, this needs to be debunked ASAP.

I don't think Aimia is really in any immediate danger of going belly up, not from a financial standpoint anyway but the company needs to take charge of the situation or people will draw their own conclusions and imagine the worse.

I deliberately emphasized part of my own quotes. As you can see, even a week prior to Aimia CEO finally came out and started to engage the public, I already sensed the market was overreacting and the why was explained in my post. The problem affecting Aeorplan is not fundamentally based, but rather emotions. We tend to think investors as logical beings but we also seem to forget they are humans like you and me, and other Aeroplan members.

I criticized Aimia for not coming out earlier to engage the public because that would have helped the company stemming the tide of free falling stock prices, which are being affected by nothing but raw emotions. By the time the CEO finally came out and issued his statement, some investors may be overjoyed by the attempt to engage and reassure, the truth is, the damage is already done. The effort is appreciated, for a time, but the lack of substance will likely do little to stem the tide. Many institutional investors will be paying a lot of attention to the dividend and if they don't like where things are going or if they panic, things could still go much further south for Aimia's stock prices.

We've shifted our earning of aeropeso from our ae cards, to other cards. We're also looking for redemptions soon than later. ae need to transform to an Air Miles kind of company, but AM got a headstart in signing up lots more companies. The future just doesn't look good for ae.

Which will not be possible for most Canadian residents

#624

Join Date: Aug 2001

Location: Ottawa and Montreal

Programs: SPG Gold / IHG Spire / Emerald Executive Elite

Posts: 457

PointWeasel: migrate to US based program: "will not be possible for most Canadian residents"

I believe United's MP can be as attractive as AP in terms of collecting points while flying. Also, awards are more plentifull, and there are little scamcharges, even on Air Canada metals.

Obviously, you can't collect points in any Canadian merchants currently, but that can change if demand materializes.

If MP expands in Canada, Air Canada would certainly not cooperate much more thought...

----------------------------------------------------------

FWIW: You can open a US Chase bank account and they'll get you a Chase MileagePlus Explorer CC if you want (As a Canadian, I got one easily).

I believe United's MP can be as attractive as AP in terms of collecting points while flying. Also, awards are more plentifull, and there are little scamcharges, even on Air Canada metals.

Obviously, you can't collect points in any Canadian merchants currently, but that can change if demand materializes.

If MP expands in Canada, Air Canada would certainly not cooperate much more thought...

----------------------------------------------------------

FWIW: You can open a US Chase bank account and they'll get you a Chase MileagePlus Explorer CC if you want (As a Canadian, I got one easily).

#625

Join Date: Jan 2016

Location: YYZ

Programs: FOTSG Tangerine Ex E35k (AC)

Posts: 5,612

Don't think I've seen this mentioned but I was just on the FT home page and there is a note about this saying "Don’t Panic, But Air Canada Is Dropping"

Now the entire text is "Don’t Panic, But Air Canada Is Dropping Aeroplan" but with the last word missing it looks a little unfortunate!

Now the entire text is "Don’t Panic, But Air Canada Is Dropping Aeroplan" but with the last word missing it looks a little unfortunate!

#626

Join Date: Apr 2007

Location: Toronto, Ont., Canada

Programs: Aeroplan; Marriott Platinum; IHG Platinum; Best Western Diamond

Posts: 2,165

AC is so smart.

1. Spin off (sell out) their FF program with a relationship. Receive a bundle of money.

2. Break off that relationship and create a new FF program. See that sold out company fail.

Repeat.

Do that a few times, receive many bundles of money.

1. Spin off (sell out) their FF program with a relationship. Receive a bundle of money.

2. Break off that relationship and create a new FF program. See that sold out company fail.

Repeat.

Do that a few times, receive many bundles of money.

#627

Join Date: Aug 2001

Location: Ottawa and Montreal

Programs: SPG Gold / IHG Spire / Emerald Executive Elite

Posts: 457

So true! What a scam.

And how can you expect a third party FF program to succeed? You are adding a huge layer of complexity.

AP Shareholders (who paid Billions) expect a resonnable return. That reflects on all the scamcharges, un-availability of awards flts, and the rip-off marchandise offering.

Air Canada is definitely laughing all the way to the Caisse Populaire (ok, meant bank here)!

And how can you expect a third party FF program to succeed? You are adding a huge layer of complexity.

AP Shareholders (who paid Billions) expect a resonnable return. That reflects on all the scamcharges, un-availability of awards flts, and the rip-off marchandise offering.

Air Canada is definitely laughing all the way to the Caisse Populaire (ok, meant bank here)!

#629

Join Date: Oct 2008

Location: YYC

Posts: 4,035

I did a quick SEDI search and neither issuer has any 10%+ shareholders declared. Holdings under that by non-insiders don't have to be declared, so it's hard to find unless the entity is open about their position.

#630

Join Date: Apr 2013

Location: YVR

Programs: Ice Cream Club, AC SE MM, Bonvoy Life Plat

Posts: 2,803

Yes, not 100's of millions, but rather trillions... just 100's of trillions however...

bigger... better... I hope altitude has 16 digits like credit cards... even bigger, even better. =) (won't comment on how I feel down there right now imagining the massive loyalty hard card... metal could be useful too... wrists sometimes need a scraping here and there)

bigger... better... I hope altitude has 16 digits like credit cards... even bigger, even better. =) (won't comment on how I feel down there right now imagining the massive loyalty hard card... metal could be useful too... wrists sometimes need a scraping here and there)