A3 financial results [last update Nov 2023, Q3 2023 results]

#17

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,697

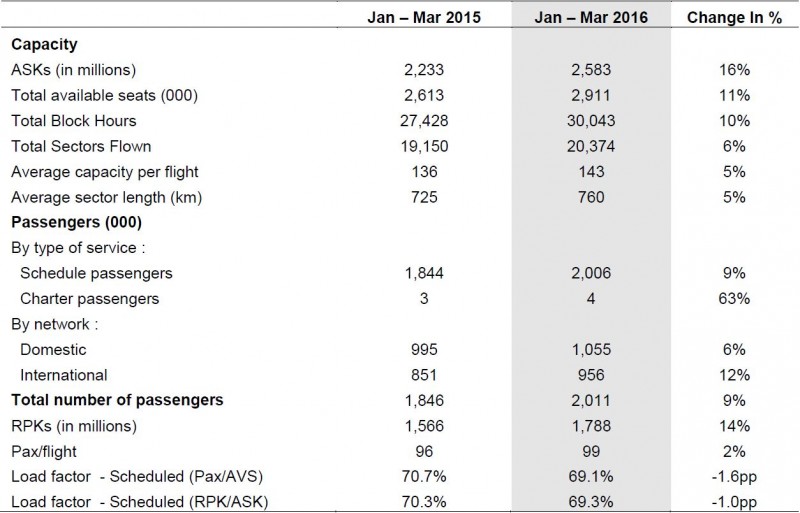

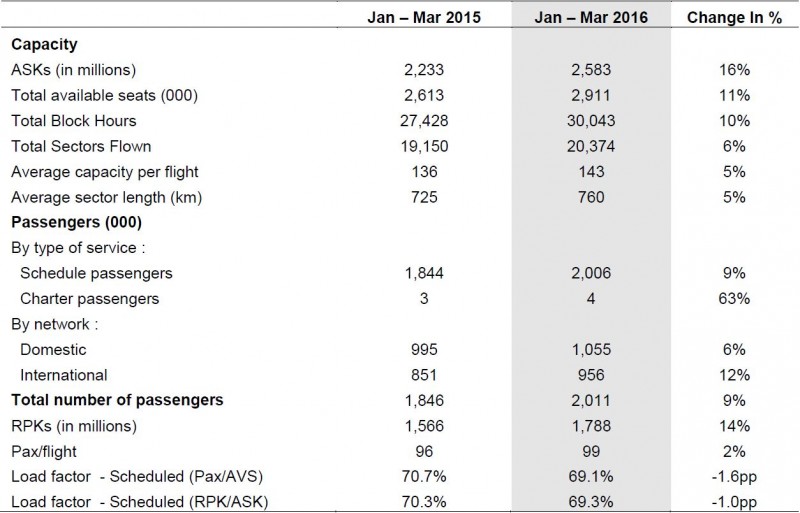

Eek! Load factor dipped below 70%!

Originally Posted by CAPA

In 1Q2016, the Aegean Airlines group's net loss widened by 159% to EUR22 million. The result was additionally burdened by higher finance costs than in the same period last year, partly mitigated by a higher tax credit. The operating loss, which excludes these items widened by 58% to EUR28 million.

Revenue grew by 7% and the operating margin fell by 6.1ppts to -18.7%. Aegean's operating margin has suffered a year on year decline in every quarter since 4Q2014.

Revenue grew by 7% and the operating margin fell by 6.1ppts to -18.7%. Aegean's operating margin has suffered a year on year decline in every quarter since 4Q2014.

#18

Join Date: Jan 2004

Location: Heraklion, Greece

Posts: 7,564

They offered a logical explanation: All of their new planes were delivered to them a few months ago and, rather than parking them idle somewhere, they started flying some of their "seasonal" routes already last winter. They consider the fact that the load factor only fell by that little a very promising fact. Who knows, they may be right...

#20

Original Poster

Join Date: Jun 2006

Posts: 5,885

Taking all that into account. One can flood the market with cheap seats but yields is another matter. Whilst Greek tourism is up and the trend is set to continue the figures will speak for themselves come Q3/Q4 results. I hope I and others are wrong and I have always been very optimistic but some things point to a different story this year.

#21

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,697

They offered a logical explanation: All of their new planes were delivered to them a few months ago and, rather than parking them idle somewhere, they started flying some of their "seasonal" routes already last winter. They consider the fact that the load factor only fell by that little a very promising fact. Who knows, they may be right...

They do seem to have upgauged in the course of the last year - the average number of seats per flight increased by 5% to 143 seats per flight.

However, planning is a little bit more complex than merely putting a plane in the air as soon as it arrives. I presume that they may have retired/returned/sold some older planes and/or make the most efficient use of their fleet (upgauging/downgauging to meet demand, using newer, more fuel-efficient aircraft where possible, etc). The old adage that "you can't earn money while a plane is on the ground" is true, but the corollary is also true - you lose money if you put more plane in the sky than is warranted!

It is good to see, however, that they were able to start "seasonal" routes earlier than planned due to the (apparent) earlier-than-expected delivery of aircraft. If the demand is there and not being met, then of course it makes sense to meet that demand rather than sitting on your hands and holding off 'til the outdated scheduled start of service...as long as the extra capacity can be put to use, then it should be put to use.

#22

Join Date: Jul 2014

Location: Wedged somewhere between BTS and VIE ✈

Programs: Star Alliance Gold (A3 Gold), Oneworld Emerald (BA Gold), Hilton Diamond

Posts: 6,338

#23

Original Poster

Join Date: Jun 2006

Posts: 5,885

As I posted before I was worried about losses going forward. Lets hope the next results balance things out.

-----

First Half 2016 Financial Results

Monday, 19-09-2016

5% rise in traffic to 5.2m passengers

Weak demand weighs on second quarter results

Kifissia, 19 September 2016

AEGEAN announces first half 2016 results with consolidated revenue at €403.5m, flat versus the respective period in 2015. Total number of passengers carried rose by 5% to 5.2m.

AEGEAN and Olympic Air carried 2.5m passengers on domestic flights while international passenger traffic rose by 10% to 2.7m passengers.

The group reported consolidated net loss after tax at €23.7m compared to net earnings of €14.8m in 2015 during the seasonally weaker first half.

During the first half of year, the group recorded a positive trend in passenger traffic which nevertheless felt short of the capacity invested in the international network, with the shortfall being more pronounced during the second quarter of the year.

In the domestic market, the weak economy, the significant increase in competitors’ capacity as well as the increase in VAT by 11 ppt (from 13% to 23% and then 24%) led to further pressure on net average fares. On the other hand, tourist arrivals in the international market, where the company as well as competitors invested significant additional capacity, grew on low single digit rates in the second quarter of the year. As a result of the imbalance between capacity growth and incoming traffic growth, especially during May and June, load factors and yields declined, mainly in the seasonal regional bases but also in Athens.

https://en.about.aegeanair.com/media...ncial-results/

-----

First Half 2016 Financial Results

Monday, 19-09-2016

5% rise in traffic to 5.2m passengers

Weak demand weighs on second quarter results

Kifissia, 19 September 2016

AEGEAN announces first half 2016 results with consolidated revenue at €403.5m, flat versus the respective period in 2015. Total number of passengers carried rose by 5% to 5.2m.

AEGEAN and Olympic Air carried 2.5m passengers on domestic flights while international passenger traffic rose by 10% to 2.7m passengers.

The group reported consolidated net loss after tax at €23.7m compared to net earnings of €14.8m in 2015 during the seasonally weaker first half.

During the first half of year, the group recorded a positive trend in passenger traffic which nevertheless felt short of the capacity invested in the international network, with the shortfall being more pronounced during the second quarter of the year.

In the domestic market, the weak economy, the significant increase in competitors’ capacity as well as the increase in VAT by 11 ppt (from 13% to 23% and then 24%) led to further pressure on net average fares. On the other hand, tourist arrivals in the international market, where the company as well as competitors invested significant additional capacity, grew on low single digit rates in the second quarter of the year. As a result of the imbalance between capacity growth and incoming traffic growth, especially during May and June, load factors and yields declined, mainly in the seasonal regional bases but also in Athens.

https://en.about.aegeanair.com/media...ncial-results/

#24

Join Date: Jun 2008

Programs: TK*G (E+), IHG Plat Ambassador

Posts: 7,884

#25

Join Date: Jun 2008

Programs: TK*G (E+), IHG Plat Ambassador

Posts: 7,884

Great Q3

This came in our Corporate T/Agency newsletter:

November 16, 2016

Aegean announces a trading update for the Nine Month period ending September 30, 2016 with consolidated revenue at €819.9m, 3% higher versus 2015. Total number of passengers carried rose by 6% to 9.8m.

Domestic passenger traffic rose by 2% to 4.5 million while passengers carried on the international network rose by 10% to 5.3 million.

During the third and most important quarter of the year, revenue rose by 7% to €416.3m with net earnings 11% higher at €74.9m.

The strong performance of the third quarter moderated to a certain extent the negative impact of first half results, leading to nine month revenue of €819.9m and net earnings at €51.2m.

The main drivers behind the positive set of results in the quarter were the rebound in demand as of July, the positive performance of key established international routes served as well as newly launched during the last two years and increased connecting flows out of Athens.

Cash and cash equivalent, including short term financial investments, reached €299m[1] at 30.09.2016.

Mr. Dimitris Gerogiannis, Managing Director, commented:

‘During the most important quarter of the year, AEGEAN delivered improved load factors and profitability whilst strengthening its position on the main bases.

The significant expansion undertaken with 61 aircraft covering a network of 145 destinations as well as the continuously improving recognition of our product and brand awareness on our international network yielded positive results and contributed to improved profitability and strong cashflow for the quarter.

However, the improvement in the third quarter could not fully cover the weak demand which we experienced in the second quarter of the year as well as the negative impact from an 11 percentage points increase in Value Added Tax on domestic travel. We remain cautious as for the remainder of the year given our heavier dependence on local demand during the fourth quarter of the year which remains weak given the recessionary environment.’

Source: Aegean Airlines

Aegean announces a trading update for the Nine Month period ending September 30, 2016 with consolidated revenue at €819.9m, 3% higher versus 2015. Total number of passengers carried rose by 6% to 9.8m.

Domestic passenger traffic rose by 2% to 4.5 million while passengers carried on the international network rose by 10% to 5.3 million.

During the third and most important quarter of the year, revenue rose by 7% to €416.3m with net earnings 11% higher at €74.9m.

The strong performance of the third quarter moderated to a certain extent the negative impact of first half results, leading to nine month revenue of €819.9m and net earnings at €51.2m.

The main drivers behind the positive set of results in the quarter were the rebound in demand as of July, the positive performance of key established international routes served as well as newly launched during the last two years and increased connecting flows out of Athens.

Cash and cash equivalent, including short term financial investments, reached €299m[1] at 30.09.2016.

Mr. Dimitris Gerogiannis, Managing Director, commented:

‘During the most important quarter of the year, AEGEAN delivered improved load factors and profitability whilst strengthening its position on the main bases.

The significant expansion undertaken with 61 aircraft covering a network of 145 destinations as well as the continuously improving recognition of our product and brand awareness on our international network yielded positive results and contributed to improved profitability and strong cashflow for the quarter.

However, the improvement in the third quarter could not fully cover the weak demand which we experienced in the second quarter of the year as well as the negative impact from an 11 percentage points increase in Value Added Tax on domestic travel. We remain cautious as for the remainder of the year given our heavier dependence on local demand during the fourth quarter of the year which remains weak given the recessionary environment.’

Source: Aegean Airlines

#26

Original Poster

Join Date: Jun 2006

Posts: 5,885

Something that could really effect A3 its getting quite serious and will be a lot worse then the last time.

Grexit? Greece again on the brink as debt crisis threatens break with EU

Country faces critical few weeks as it struggles to meet bailout conditions and pressures rise in Germany and US

https://www.theguardian.com/world/20...-eu-germany-us

Grexit? Greece again on the brink as debt crisis threatens break with EU

Country faces critical few weeks as it struggles to meet bailout conditions and pressures rise in Germany and US

https://www.theguardian.com/world/20...-eu-germany-us

#27

Join Date: Jan 2016

Location: LHR/ATH

Programs: Amex Platinum, LH SEN (Gold), BA Bronze

Posts: 4,489

Something that could really effect A3 its getting quite serious and will be a lot worse then the last time.

Grexit? Greece again on the brink as debt crisis threatens break with EU

Country faces critical few weeks as it struggles to meet bailout conditions and pressures rise in Germany and US

https://www.theguardian.com/world/20...-eu-germany-us

Grexit? Greece again on the brink as debt crisis threatens break with EU

Country faces critical few weeks as it struggles to meet bailout conditions and pressures rise in Germany and US

https://www.theguardian.com/world/20...-eu-germany-us

A3 would be affected severely by collecting Drachma in Domestics but then their costs will fall as things in GR (airport lease, landing fees, staff) will be paid in Drachma.

A3 would survive the Grexit in my opinion.

#28

FlyerTalk Evangelist

Join Date: Mar 2008

Location: Netherlands

Programs: KL Platinum; A3 Gold

Posts: 28,697

This report is probably out of date - I doubt Aegean/Olympic still has a 90% share of the domestic market (see below), though the foreign operators now operating in the Greek domestic market could quickly exit the market should future dips in demand - like the 26% fall in domestic demand mentioned in that article - occur again, especially if accompanied by reversion to the drachma. Ryanair, in particular, would show no hesitation in exiting the domestic market if it no longer deemed services viable. However, international demand would likely pick up again quite rapidly after any post-Grexit stabilisation, on the assumption that a devalued Greek currency would make Greece an attractive destination, price-wise, for foreign tourists.

Originally Posted by Ekathimerini

This summer [Summer 2016] there will be a total of 122 weekly flights from Eleftherios Venizelos Airport to island and mainland destinations within Greece by foreign airlines, of which 14 services are new additions.

Last edited by irishguy28; Feb 6, 2017 at 8:00 am

#29

Original Poster

Join Date: Jun 2006

Posts: 5,885

There will be winners and loosers. FR are already adjusting their Domestic operations although JMK is getting a large increase in capacity. Of course you have to read between the lines with anything coming from Harp HQ as they often create excuses and fights to get their own way ( or at least try to ) .

The Thessaloniki works and the termination of the Athens-Paphos route have also resulted in the reduction of Ryanair seat availability by 17 percent from Athens and 7 percent from Thessaloniki for this summer. Ryanair is further cutting seat capacity by 5 percent from Santorini, 11 percent from Cephalonia, 15 percent from Rhodes, 17 percent from Corfu and 100 percent from Kos.

However, it is increasing seat availability for this summer from Myconos, by 39 percent, and from Hania, by 4 percent, while starting two new international routes from Athens this winter, to Katowice and Krakow, flying to those Polish cities twice a week.

http://www.ekathimerini.com/215780/a...ns-fires-shots

The Thessaloniki works and the termination of the Athens-Paphos route have also resulted in the reduction of Ryanair seat availability by 17 percent from Athens and 7 percent from Thessaloniki for this summer. Ryanair is further cutting seat capacity by 5 percent from Santorini, 11 percent from Cephalonia, 15 percent from Rhodes, 17 percent from Corfu and 100 percent from Kos.

However, it is increasing seat availability for this summer from Myconos, by 39 percent, and from Hania, by 4 percent, while starting two new international routes from Athens this winter, to Katowice and Krakow, flying to those Polish cities twice a week.

http://www.ekathimerini.com/215780/a...ns-fires-shots

#30

Original Poster

Join Date: Jun 2006

Posts: 5,885

April – May 2017 Passenger Traffic

2 million passengers and overall international traffic increased by 15%, while traffic to Athens increased by 19%!

AEGEAN’s international passenger traffic increased by 15% during April and May 2017, if compared to the same period in 2016. Significant momentum was achieved with the commencement of the summer season and the transportation of 1.2 million passengers. The Athens base—with the contribution and maturity of destinations launched in 2015 and 2016, but also with new destinations – launched in 2017—recorded the largest increase, with international passengers increasing by 19%.

Overall passenger traffic in the domestic and international network amounted to 2.1 million passengers, recording an 8% increase if compared to 2016. Even in the domestic network, the company maintained its total number of passengers stable, despite the reduction in Public Service Obligation Routes operated by Olympic Air, and the entry of new competitor airlines to the market.

https://en.about.aegeanair.com/media...oy-maioy-2017/

---

First Quarter 2017 Trading Update

Higher passenger traffic with improved load factors

Kifissia, 23 May 2017

AEGEAN announces a trading update for the First Quarter of 2017 showing consolidated revenue at €151.9m, 3% higher compared to €147.9m in the first quarter of 2016. Passenger traffic rose by 5% compared to 2016, reaching 2.1m passengers, with significantly improved load factors. The company operated 7% less flights compared to the respective period in 2016.

Net losses after tax stood at €35.8m from €21.5m in the respective quarter of 2016. Fleet underutilization in the winter months along with the move of Easter into the second quarter of the year, weighed on results of the seasonally weakest quarter of the year.

Traffic in the international network increased by 17%. On the other hand, domestic traffic was 6% lower, as the Company adjusted the activity to soft demand with lower fares, reduced flights and hence achieving improved load factors.

Cash & financial investments reached €262m at period end 31.03.2017 [1].

https://en.about.aegeanair.com/media...rading-update/

2 million passengers and overall international traffic increased by 15%, while traffic to Athens increased by 19%!

AEGEAN’s international passenger traffic increased by 15% during April and May 2017, if compared to the same period in 2016. Significant momentum was achieved with the commencement of the summer season and the transportation of 1.2 million passengers. The Athens base—with the contribution and maturity of destinations launched in 2015 and 2016, but also with new destinations – launched in 2017—recorded the largest increase, with international passengers increasing by 19%.

Overall passenger traffic in the domestic and international network amounted to 2.1 million passengers, recording an 8% increase if compared to 2016. Even in the domestic network, the company maintained its total number of passengers stable, despite the reduction in Public Service Obligation Routes operated by Olympic Air, and the entry of new competitor airlines to the market.

https://en.about.aegeanair.com/media...oy-maioy-2017/

---

First Quarter 2017 Trading Update

Higher passenger traffic with improved load factors

Kifissia, 23 May 2017

AEGEAN announces a trading update for the First Quarter of 2017 showing consolidated revenue at €151.9m, 3% higher compared to €147.9m in the first quarter of 2016. Passenger traffic rose by 5% compared to 2016, reaching 2.1m passengers, with significantly improved load factors. The company operated 7% less flights compared to the respective period in 2016.

Net losses after tax stood at €35.8m from €21.5m in the respective quarter of 2016. Fleet underutilization in the winter months along with the move of Easter into the second quarter of the year, weighed on results of the seasonally weakest quarter of the year.

Traffic in the international network increased by 17%. On the other hand, domestic traffic was 6% lower, as the Company adjusted the activity to soft demand with lower fares, reduced flights and hence achieving improved load factors.

Cash & financial investments reached €262m at period end 31.03.2017 [1].

https://en.about.aegeanair.com/media...rading-update/